By Larry Chiang

Starting up a FICO score over 700 is my specialty. I have been doing it since my sophomore year in college. College was a long time ago… If you would like a FICO of 720, 740, 748.8, 800 or 820 as a 17 1/2 year old, know that there are data points (pun intended).

All of this you can do even if you are not Stanford engineering bound. Stanford Engineering has a lot of great content on YouTube for starting up. These are the data points to show you that the credit system was engineered to be against you:

(1) After you are a regulator at the Federal Trade Commission, you can go work for Experian, TransUnion and Equifax. You may even work at Fair Isaac after you quit working at the FTC.

[2] While you cannot help your age and there are laws against discriminating against ageism, age is in the credit score. Age of accounts is in the credit score.

If you are 17.9 years old, it will be very difficult to start-up (pun intended to connect to business starting up) your credit. Credit score establishment will be verrrrry difficult.

If you wait until after 21 to startup your credit report, it will be even more difficult

{3} If you are wealthy with zero debt. You will actually have bad credit. If you have a mortgage paid off and own 100% of your home, you FICO score drops like a rock.

(4) The majority of people think a debit card helps you only spend money that you have in your account. A debit card is a huge fee generator that generates revenue for banks. A debit card is a really bad credit card. Debit cards have ‘authorization holds’ where you will over draw. Overdraws result in overdraft fees.

[5] Terms of Service. The reason that the venture capital firm presents you with a 35 page contract is that there are terms of service written to help the VC. Ditto banks. Banks write Terms of Service to benefit you.

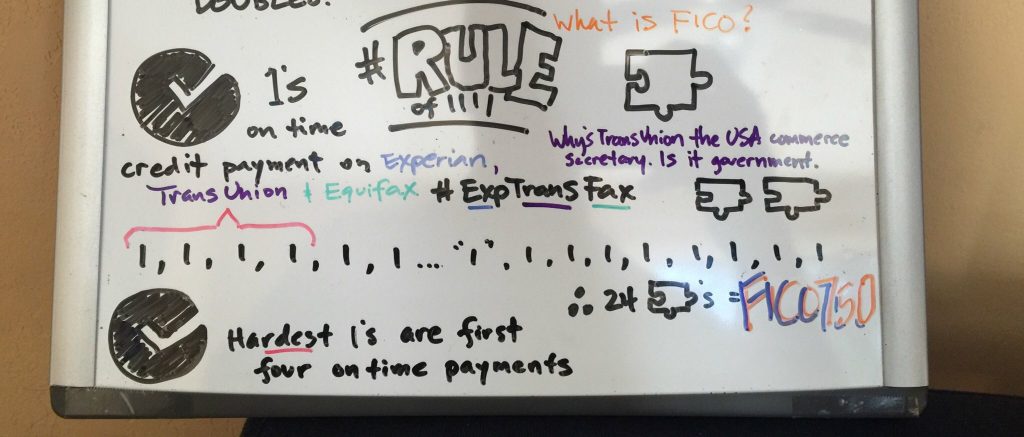

GREAT NEWS: “24 1s help you get to a FICO of about 760 as of May 8, 2017”

GREAT NEWS: “24 1s help you get to a FICO of about 760 as of May 8, 2017”

{6} Rule of 72. Before the Theory of Relativity, Albert Einstein was figuring out how compound interest works. 72 divided by the interest rate equal ‘time it takes for money (or debt) to double’. Guess what?! Interest on a credit card compounds pretty fast. And you know what is more profitable than a bank’s credit card?! You guessed it. Debit cards are more profitable.

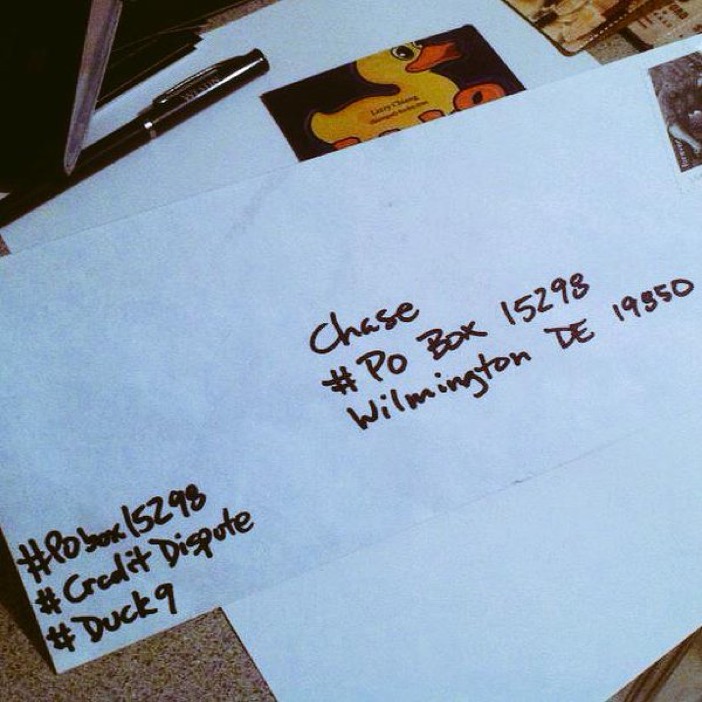

Downtown Palo Alto mailbox

Downtown Palo Alto mailbox

(7) HR627. House of Representatives bill 627 was made into a law. The Credit Card Card Act was meant to eliminate predatory practices banks use against us. But, guess what… banks have some really great lawyers and lobbyists too. And these banks read all about #cs183law and engineer products to maximize profit.

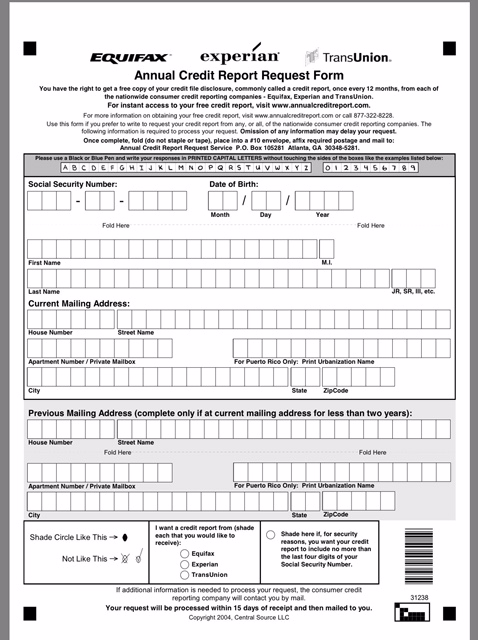

Mail form #poBox105281 into PO box 105281 in ATL GA 30348. Be scared that I memorized that box number

Mail form #poBox105281 into PO box 105281 in ATL GA 30348. Be scared that I memorized that box number

Text me your full address and I will mail you this 8 1/2 x 11 form for $3.oo

Text me your full address and I will mail you this 8 1/2 x 11 form for $3.oo

{8} World Wide Web. On your mobile phone, you can access webpages. But web page technology has not yet come to the credit industry. If you would like to access your own credit information, www access is very close to impossible.

(9) Data point. 31 American postage stamps affixed to thirty-one ‘#10 envelopes’ means you will adhere to and actually leverage a 1970s law written to protect you. Yup, the Fair Credit Reporting Act

10/ Why are there so many credit coaches out there compared to jogging coaches?

Jogging is just-do-it.

Credit (and entrepreneurship) coaching is because almost all of it is counterintuitive

Photo credit Bianca Doria @biancadoe

Photo credit Bianca Doria @biancadoe

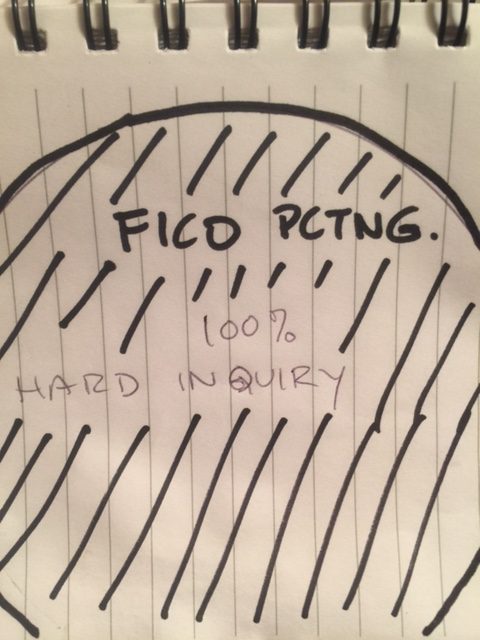

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO:

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO: