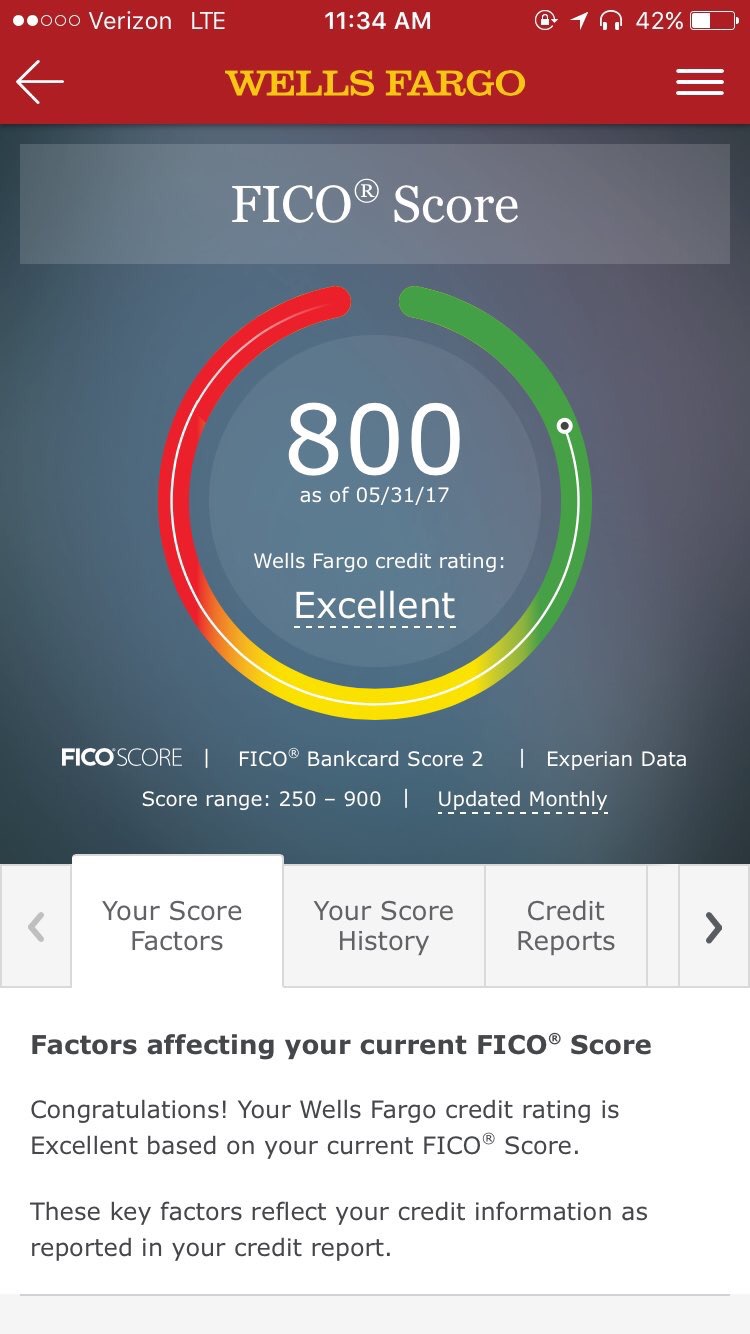

Larry Chiang graduated with a FICO over 800 and has a Jedi in Business Administration (J.B.A.) Like a Jedi, he was padawan to Mark McCormack who wrote, “What They Don’t Teach You at Harvard Business School”. Chiang self-funded Duck9 like McCormack self-funded IMG Sports Agency.

This is why Twitter is great!! I searched “credit score” and found this. My comments are clearly marked

| 🌻 (@__tdx) | |

|

everyone always asks me how I have such a high credit score at 19 … brothas, sistas, y’all ready? credit: a thread

|

|

|

🌻 (@__tdx) |

|

the minute I turned 18 I applied for a credit card. don’t listen to your parents when they say “don’t get a credit card”

|

|

Larry CHIANG: A lot of parents got burned so they say don’t get a credit card. Use your real social security number at a bank when you apply for credit.

#3

|

🌻 (@__tdx) |

|

BUT don’t be that idiot with a credit card either. get your cc from your bank not one of these private companies. and get a low limit ($300)

|

|

Larry CHIANG: yes, a $300 limit is great.

|

🌻 (@__tdx) |

|

wait to use it until you have a pay check from your job. use that cc to pay off some bills then wait a week, use that check to pay your cc.

|

|

Larry CHIANG: Record exactly how much you spend on your credit card.

|

🌻 (@__tdx) |

|

your credit score will sky rocket because that’s the only thing you have on your report at the moment. but at a young age you can’t do much.

|

|

Larry CHIANG: A lot of people never start their own credit score. A lot of people have their social security number locked away so deeply that it hurts.

|

🌻 (@__tdx) |

|

once you use and pay off that $300, spend $150 of it and have minimum payments on auto pay (mine is like $12 a month) and just let it ride

|

|

Larry CHIANG: I just would recommend charging $20 and paying $20. 150.oo is dangerous. I manually check the balance on my credit card’s iPhone app. I also log in every Thursday to pay 100% of what I owe.

|

🌻 (@__tdx) |

|

that’ll boost your score up each month and it gets reported to the credit bureau.

|

|

Larry CHIANG: yes!!!

|

🌻 (@__tdx) |

|

DO NOT CHECK YOUR CREDIT SCORE OFTEN 🗣 when you run your credit it takes points, when businesses run it that takes even more.

|

|

Larry CHIANG: when you run your own credit, your score is not impacted. When a consumer runs their own credit report, it’s a “consumer inquiry”. Consumer inquiries do not show up. Consumer inquiries do not impact your FICO. Advertiser inquiries do impact as soft inquiries. Credit and business inquiries hurt your credit score. Consumer inquiries are when you look at your own credit reports from Experian, Trans Union and Equifax.

|

🌻 (@__tdx) |

|

you will get a credit report from your T bank so don’t worry.

|

|

|

🌻 (@__tdx) |

|

if you have a contract phone, PLEASE get it in your name. that phone is on credit so paying your phone bill will boost your score.

|

|

Larry CHIANG: Spot on! Paying a cellphone bill helps a lot.

|

🌻 (@__tdx) |

|

a lot of college kids get these apartments with their parents as cosigners, DONT. I got my first and second apartment in MY NAME.

|

|

|

🌻 (@__tdx) |

|

your deposit will be larger, but if you save up, you’ll be able to afford it. that gave me soooo many points on my credit score because I

|

|

|

🌻 (@__tdx) |

|

self qualified, had my deposit ready and paid my rent and bills six months in advance.

|

|

|

🌻 (@__tdx) |

|

so now you’re about six months in on your credit journey and at this point you should have close to a 600 (fair is about 620)

|

|

Larry CHIANG: No comment.

|

🌻 (@__tdx) |

|

after you have established good credit building, time for more credit cards! but not with your bank …

|

|

|

🌻 (@__tdx) |

|

store credit cards are awesome. I personally have VS, F21, Kohls and Banana Republic.

|

|

|

🌻 (@__tdx) |

|

I have huge boobs so I of course use my VS cc for bras only lol because they’re expensive. and I auto pay $16 a month on it

|

|

|

🌻 (@__tdx) |

|

but I don’t really use my other ones. I bought about $150 worth from each and have $8 autopay on them all each month.

|

|

|

🌻 (@__tdx) |

|

when my direct deposit is more than what I expected, I always always always make extra payments on my credit cards!

|

|

|

🌻 (@__tdx) |

|

don’t run your credit often. when trying to find a car, house, etc, limit yourself to a few businesses so you’re not running your credit. Z

|

|

|

🌻 (@__tdx) |

|

that’s literally all I’ve done. get credit cards and have a plan. phone in my name, apartment in my name, cc bills on autopay, no running it

|

|

|

🌻 (@__tdx) |

|

currently, I have a 694 (previously I had a 730 but I did slip up … things happen).

|

|

Larry CHIANG: I bet the slip up is from a department store. Remember, the store makes $5 selling the Victoria’s Secret bra but $10 on the forever 21/ Banana Republic interest and junk fees

|

🌻 (@__tdx) |

|

one small slip up can dock you 2-100 points so BE CAREFUL! my mistake took me from perfect to good credit. but I can still get approved

|

|

Larry CHIANG: one small slip up can dock you 2-30 points – one small chargeoff up can dock you 100 points

|

🌻 (@__tdx) |

|

for almost ANYTHING I’ve ever wanted with my 600+ …. I’m 19

|

|

|

🌻 (@__tdx) |

|

strive for that 700+ score so no one can tell you shit. God bless you all.

|

|

|

🌻 (@__tdx) |

|

note there’s more than one credit bureau and more than one type of credit so be mindful of EVERYTHING I’ve said and not just the credit card

|

|

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO:

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO: