|

James Raynor (@JamesRa74709682) |

|

â¦â€ª@spencernoon‬⩠â¦â€ª@SushiSwap‬⩠I really wonder how an anon dev with a copycat of YAM and an vague Idea of draining Uniswap gets listed on Binance 2 days after its birth.

I dont think it was volume alone tho, IMO you need serious connections to pull this of. |

|

Aug 20

|

🍣 SushiSwap | sushiswap.eth (@SushiSwap) |

|

1/ Introducing #SushiSwap🍣, an evolution of #Uniswap with $SUSHI tokenomics. SushiSwap protocol better aligns incentives for network participants by introducing revenue-sharing & network effects to the popular AMM model.

|

|

|

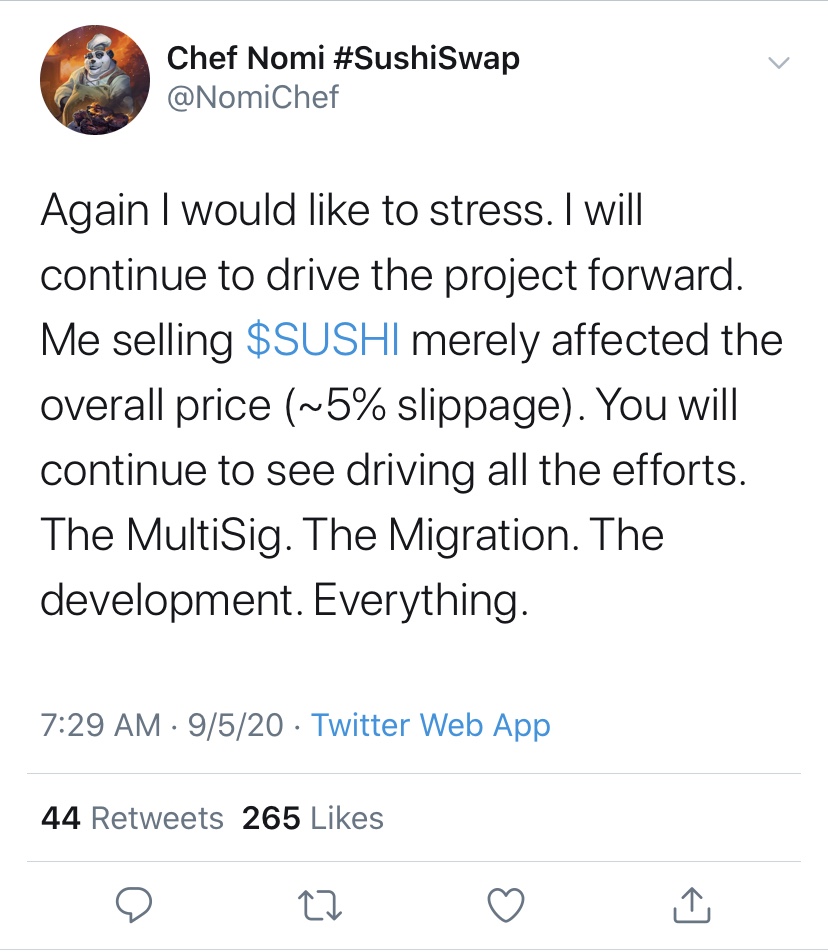

Chef Nomi #SushiSwap (@NomiChef) |

|

I did the recent move because I care about the community. I’m taking IL for you. But all I received was blaming and FUDing.

Here’s what happened. The devshare part of me. I converted them to $ETH. I stop caring about price and I will focus on the technicality of the migration. |

|

|

Martin(a) Krung (@martinkrung) |

|

Liquidity on some liquidity dependent protocol has a market anomaly, because liquid liquidity has the same value as illiquid liquidity and this is a very powerful attack vector right now. In traditional finance illiquid liquidity is more valuable than liquid liquidity.

|

|

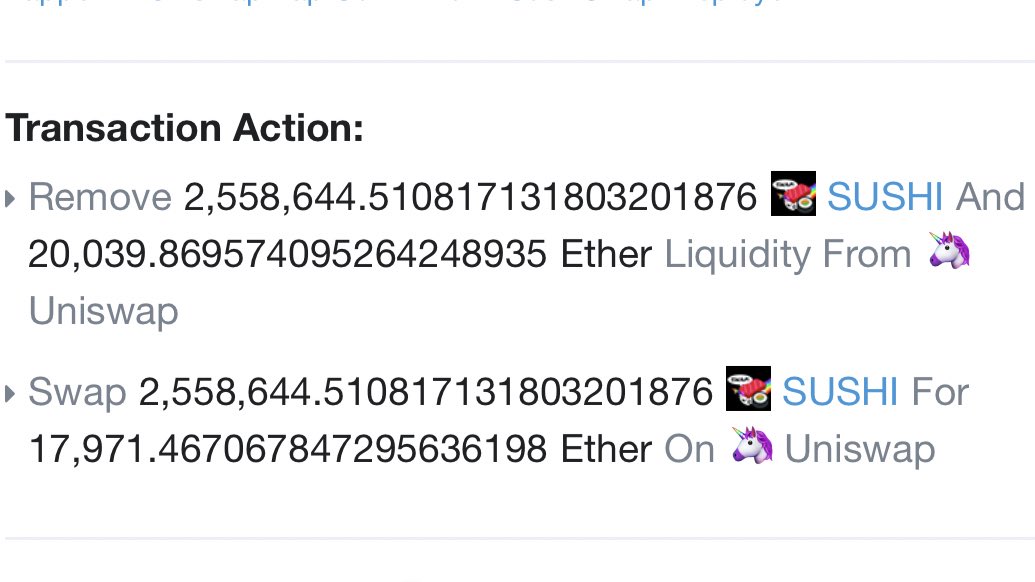

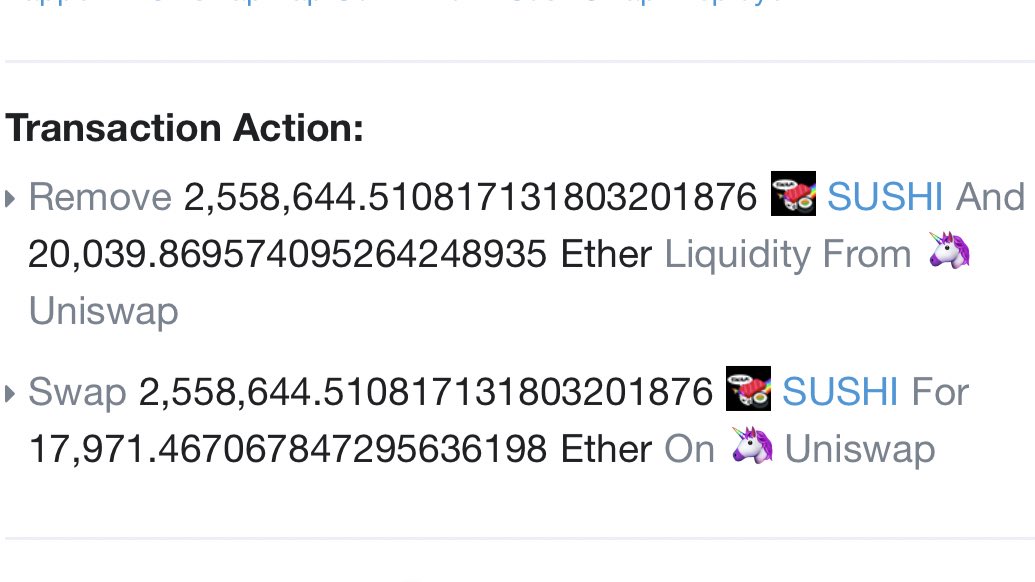

Founder, exits

The sushi is swapped.

|

Spencer Noon (@spencernoon) |

|

BREAKING 🚨

Anonymous founder of â¦â€ª@SushiSwap‬⩠sells all of his $SUSHI 🍣 WHO COULD HAVE POSSIBLY PREDICTED THIS?! pic.twitter.com/cEje9335fZ |

|

https://www.youtube.com/watch?v=ejeIz4EhoJ0

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO:

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO: