By Larry Chiang

This will be an incendiary post about money.

To be fair, verrrry few understand money and the patterns that emerge prior to taking in a single digit million amount of United States dollar. To be empirical, women I’ve met have swallowed up this knowledge and gobbled up the common sense things that appear at uncommon frequency. To be harsh, many men cry like babies with dysintery when faced with the emotional climb in order to grasp at money.

Let’s delve into this scandalously titled article which won’t be appearing over my Fast Company trove of articles…

-1- Treasure management is different from Treasure Acquisition.

Making money is so very hard. Since I read the book, “The Hard Part About the Hard Parts”, let us focus points 2 ~ #10 on making money so that we have Treasure to manage.

-2- Potential almost never translates.

Potential to earn money is the most overrated. VCs can’t. Analysts that rate financial instruments are often very wrong. In judging people, women will look for financial strength and monetary earning power by analyzing

– job title

– college advanced degrees

– spending. Seriously, women think that “money out” correlates to ‘money in’ like it’s a Thermodynamic Law. More on this later…

Making money strait out of a top tier grad school into a top tier consulting gig rarely means an automatic-single-digit-million-dollar-score. Money made at a good job or realllly lucrative job rarely means Treasure to the tune of $2,000,000 – $10,000,000.

This shortfall leads directly into my next point…

-3- Moonlighting.

Moonlighting is getting a second job in addition to the primary gig that pays the bills. Even the phrase moonlighting has a connotation of making moonshine. This is a liquor. Women rarely moonlight during their tech sales job.

Jim Rohn has a famous quote about getting rich. There I said it. This article is about getting rich. This article is about how women miss out on doing technical sales and moonlighting.

Jim Rohn said that to be rich…

“You must work harder on yourself than you do on your job.”

Quitting your consulting gig at Accenture to be a millionaire like Brendon Burchard probably has moonlighting steps I do not know about.

-4- At higher levels, it’s all sales.

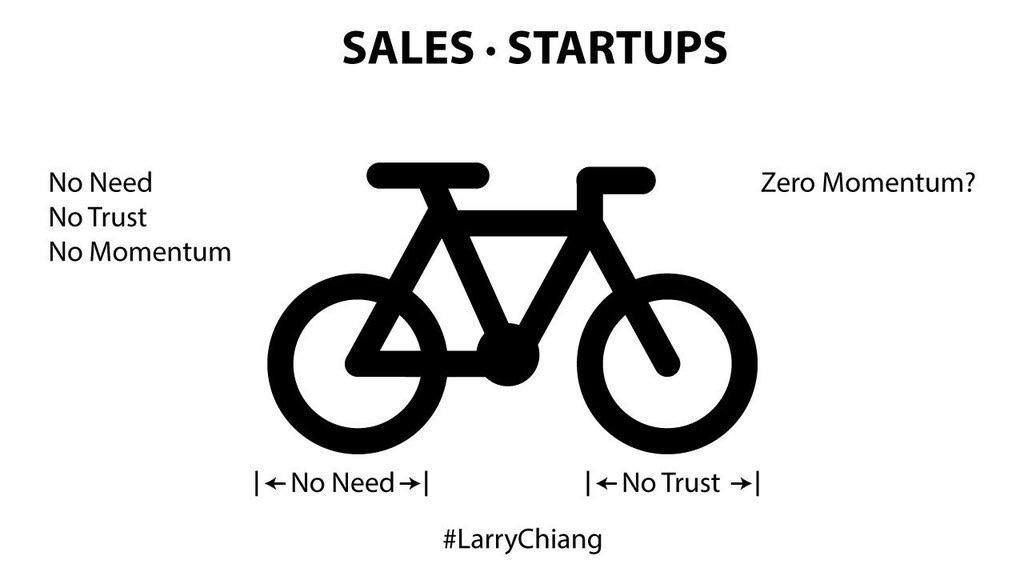

Sales. Making wealth depends on selling and sales skills placed on top of a technical degree. Sales is what makes most startups never make dollar number one.

Imagine getting a technical degree from a top 11 PAC 12 school like Stanford and then discovering that your career will stall unless you sell. This is why Asian people are never the CEO.

Tech sales.

It’s so gross to even recommend that sales has euphemisms such as “forward deployed engineer”.

-5- Trust Fund or Ponzi Scheme?

Pay close attention to phrases people use for money. Pretty much the first person to say “Are you a lottery winner?”, loses.

Wealth via value creation.

At the heart of women’s disconnect is our disconnection between value and price when we go consume purses and shoes. I say “we” because I did a stint as a woman during *gender reversal entrepreneurship* exercises. Solution: Focus on the value

Focus on the business problem solved.

-6- Talking about problems or solving problems.

Quoting my relationships’ mentor:

“Women want to vent their problems. They do not want to hear solutions.”

Wealth and making money is about

– real problems

– perceived value of solving problems.

– perceived problems.

The Venn diagrams may or may not intersect depending on your ability to generate wealth.

-7- Go back and read number 6.

All the value in Treasure Management, wealth generation and making a single digit number of millions is in #6.

-8- A Thousand Thousands is Not Easy.

How would you make $1,000 right now. Text me the answer.

-9- How does social security work.

Ask someone.

Their answer is likely wrong. Social security is a ponzi set up.

People who do not have a million think a check just magically shows up. It turns out, prior to having that seventh digit show up in your bank account there was a prior body of work the millionaire had to grind through

-10- What is the opposite of a ponzi Scheme

At the heart of millionaires, they realize that you have not needed money to make money since the Wright Brothers financed airplanes with the profit from selling bikes.

Sell something

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO:

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO: