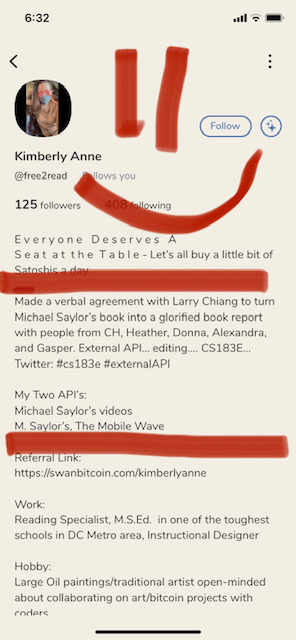

From: Kimberly Dinga @literacy_kim

Date: February 23, 2021 at 3:27:53 PM CST

To: larry <larry@duck9.com>

Subject: (No Subject)

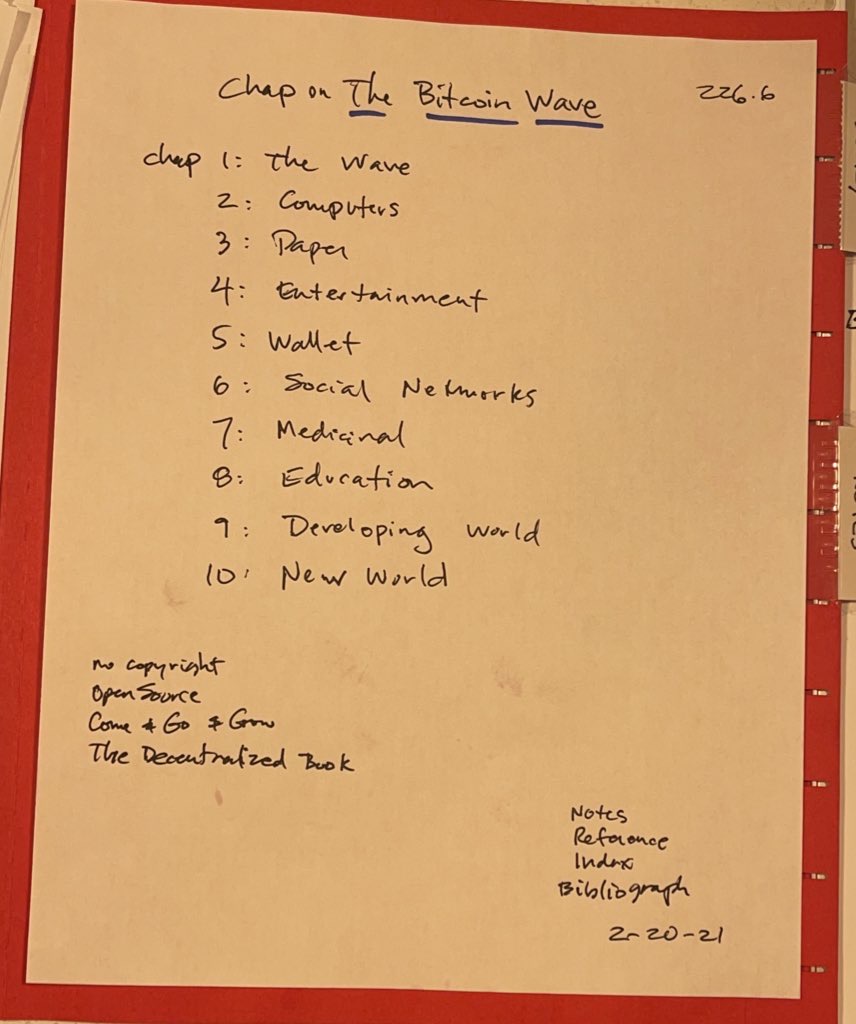

Chapter 1

The Bitcoin Wave

In the middle of winter, on a Friday night, I stumbled upon a Universal platform called Clubhouse and explored the room called “Bitcoin Escape Velocity, Retrace, Fear of Losing Statusâ€. I met several lovely strangers who later became my teammates. Larry Chaing was moderating the room and allowed me on stage where I eventually shared my story about how I got into Bitcoin.

“I have always been fascinated with technology since I was in high school,†I replied, “and I remember being the only female, besides the teacher, in an elective class called B.A.S.I.C.â€

It took me a few minutes to introduce myself, but my message was clear that I am passionate about learning, investing in myself, and helping others do the same.

“My father was a government economic teacher at a Catholic high school after he served in the Marines,†I said, “and he taught me the value of saving money.â€

I said something about how during my first year of teaching, I invested in a 403B and the financial advisor praised me for investing so early in my career.

“Not many teachers invest, you are doing the right thing,†she said.

I realized that in the past 16 years I have been holding on to a 403B like it was very valuable, but Bitcoin was arguably becoming a better investment option for me. I even made decisions about my job and location based on a secure retirement plan, for example, I never thought of moving out of Viginia for fear that I would start all over again at the bottom of the retirement Tier. That was what I was told, but Bitcoin gave me hope about my future. Even though I knew Bitcoin disrupted my thinking about centralized government and bank system, I explored Bitcoin and discovered transparency in these engineering and technology fields.

“I see Bitcoin like my retirement,†I said, “because if I need to borrow against my Bitcoin, then I would pay myself back with Bitcoin.â€

“Kimbelry, do you want to make an aggressive decision tonight?†Larry asked me with his charismatic salesman voice.

“Sure!†I replied.

I mentioned that I began reading Inventing Bitcoin by Yan Prizkar, Fiat Standard: Debt Slavery Alternative to Human Civilization by Saifedean Ammous, and The Bitcoin Mining Network by Coinshares Research. Alexandra, who later became my teammate, recommended that I watch Michael Saylor’s videos as well.

“I have so much to read right now,†I said, “so I will get to those videos as soon as I can, but for now I really want the satisfaction from finishing one book from cover to cover.â€

That night, I made a verbal agreement with Larry and hundreds of witnesses, that we would write a glorified book report about similarities of The Mobile Wave and The Bitcoin Wave. Five of us had one stone in common, a book. Michael Saylor is the founder and principal shareholder of MicroStrategy. MicroStrategy 2020 is a Modern Analytics, Open Architecture, Enterprise Platform for Intelligence applications. The guy is very bright in a dazzling way!

Larry generously tied The Mobile Wave to a Bitcoin Wave. It makes sense to me because, Saylor brilliantly stated that The Mobil Wave was marked by “Information Revolution.†(Saylor, 16). Information Revolution is characterized by, “disruption to the social structure, political systems, and economics.” (17). As you read this book, look for patterns between Saylor’s book, the original author, and this one. I appreciate Saylor’s expertise and method so much that I will borrow ideas from him to explain the Bitcoin Wave and educate the world.

I believe we live in exciting times with exciting opportunities everywhere. Bitcoin is not everywhere yet, but mobile information travels fast around the world that Bitcoin is “a peer-to-peer electronic cash, a new form of digital money that can be transferred between people or computers without any trusted middleman (such as a bank), and whose issuance is not under the control of any single party†(Prizkar, 1).

Pritzker, Yan. Inventing Bitcoin : The Technology behind the First Truly Scarce and Decentralized Money Explained. United States, 2019.

Saylor, Michael. The Mobile Wave : How Mobile Intelligence Will Change Everything. Boston, Da Capo Press, 2013.

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO:

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO: