|

Larry Chiang (@LarryChiang) |

|

The 7 Hidden Business Models of VC.

|

|

By Larry Chiang

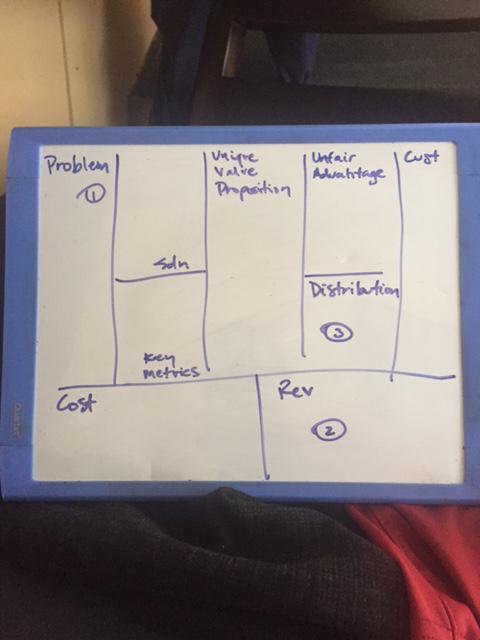

As engineers, we have mastered Engineer Up a Businesss Model. #EUBM has caused us to be creative with inbound money and “chart” problem; revenue; distribution.

Well, the masters of sexy-money have something to teach us engineers about “7 Hidden Business Models of VC”.

-1- More than buy low and sell high.

Nearly no revenue comes from buying stock at a low cost…, then selling that same stock HIGH. As an asset class, it’s historically DEAD WORST.

So, how does a VC make money!?!

-2- Carry and Management Fees

Carry is the 35/65 or 40/60 split of investment profit with your Limited Partner. See point number 1 😉 The management fee is 2.5 ~ 6%.

First money out of the fund is the management fee. Per annum.

-3- Deal insurance.

A Hidden Business Models of VC = VCs doing deal insurance. In this role, the VC is brokering a startup to be sold. This VC may or may not yet own stock. If he does not own stock, there is a simultaneous deal closing where they buy stock and then immediately sell.

Here’s how this dirty awesome deal goes down:

HIDDEN FOR DUCK9 SOCIETY MEMBERS ONLY

Jk, so VC acting as deal insurance occurs when a VC has a known relationship with a Corp Dev team. The VC is paid like a glorified business broker. The plan is structured 0-90% of expected sale price nets the VC, $0. 91-101%, small pctng. 101-105%, higher. 105+%, bonus round.

So let’s say a VC douchebag gets wind that Duck9 is in play because we are selling it to #101TryonStreet. He then intervenes with another potential buyer and then negotiates a verbal Deal insurance, deal. Verbally, plan is structured 0-90% of expected sale price nets the douchebag, $0 because we won’t sell it to American Express at 200 Vesey Street. 91-101%, minuscule pctng. 101-105%, higher. 105+%, bonus round.

The prospect of a bidding war is what this VC is selling. We are networking whores. All we do is go to boondoggles. All we do is drink exotic conflict-free coffees grown at fair-wage in the 7 Coupa Cafes in downtown and greater Palo Alto. I’d warn you off of this VC, but it’s all upside for you to enter into this deal.

-4- Quitting VC and starting a similar startup to yours.

This hidden business model makes me laugh on about 12 levels. I laugh because NDA, associates’ arrogance, eir (little EIR), execution, VC work ethic & VC school debt from their MBA.

VCs are too ADD* (attention defective disorder*) to even sit for 35 slides. How are they to even execute a startup, step-by-step-by-step.

*This ADD is VC specific. Worse than scholastic ADD because here the underlings are 30x smarter, domain-wise than the supposed teacher-advisor-mentor.

-5- VCs who charge you for office space.

Hidden business model is where your VC parks you in their office and then charges your startup team rent.

Not to sound like an Asian male, hetero supermodel who knows strippers who office in a Crate and Barrel**, but sitting in an office working should be an endeavor where we founders get paid to show up. Have you seen a Silicon Valley business incubator before 11am?!? It’s a desolate wasteland chock full of Odwalla and wall-to-wall ping pong balls. Private chefs cooking waffles sit idle.

When you VC is charging you rent, this is the genius way that the money flows.

VC ‘funds’ you. [LP money to your SVB / 1st Republic]

VC then starts charging rent. {Your SVB $$ goes to his holding company set up just to receive landlord tenant money.}

VC starts charging the city or state a fee for bringing in viable startup’s that may or may not stimulate the local economy. The fee comes from a subsidy as VC STRUCTURE 3 of 11 [which is VC is landlord and tenant and leasing overlord. BuHahahaa :-]

You get VC validation in a $800k venture capital round. The VC gets to siphon money so that we execute EUBM’s number one protocol #HTMMWYMM. How To Make Money While You Make Money leads me to my next hidden business model of VC…

-6- Recapitalization.

Pressing the reset button and erasing.

Buying stock low and selling it high is incredibly impossible for us VCs to do. Impossibly hard. Recap your ass is a cheap method to capture some sweat equity and quasi monetize it. Recaps suck. Recaps kill founder will. Recaps are often unaccompanied by hush money.

Why?!

Because VCs know that most founders just sit for the recap.

Why do founders sit for the screw!?! Because recaps are presented in a way that breaks the bad news to you stage-wise. This is not my first recap. But I bet this is the first time you have been recapped.

I wanna do another HLS lecture called “ASSymetric asymmetric recapitalization experiences and how victims just sit and take it in the buttocks”. Please place your phones in airplane mode here in Cambridge. No videos or paper notes allowed.

Debbie Downer, aside my last point is more positive

-7- Monetizing Distribution

VCs are total douchebags. But with that “look who I know”, Rolodex comes an ability to connect you with revenue.

There is this VC on Sand Hill. They have an “Executive Center” where they fly out CTO’s in the dead of winter. These Chief Technology Officers land in 80degree weather and are carted directly to the 94025. In Menlo park, they get debriefed by startup’s that get 2-10 CTO meeting in under 24 hours.

Instead of a one year hunt for these 2-10 CTO meetings all across America, the time cost is just a jaunt down 280 from The Dog Patch

What would you pay your VC for that kind of distribution?

What would you pay me for that kind of distribution!?

What would you pay an #R2D2vc as a percentage of sales and percentage of structured 0-90% of expected next VC round nets the VC, $0. 91-101%, small pctng. 101-105%, higher. 105+%, bonus round.

As an undergrad engineer, you might be licking your chops because now you realize, you do not need a $300mm fund to be a VC. You just need a small Rolodex going and execute basic douchebag business recipes.

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO:

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO: