|

||||||||||||||||||||||||

Michael Burry shorted housing in 2005.

For two years his investors called him an idiot and demanded their money back as he paid premiums to stay in his position. His fund lost 18% in a year that the S&P index was up ~10%.

Burry fired half of his staff fell into depression.

Why couldn’t his investors see the simple logic to his trade?

Meanwhile, his big bank counter-parties gaslit him the whole way.

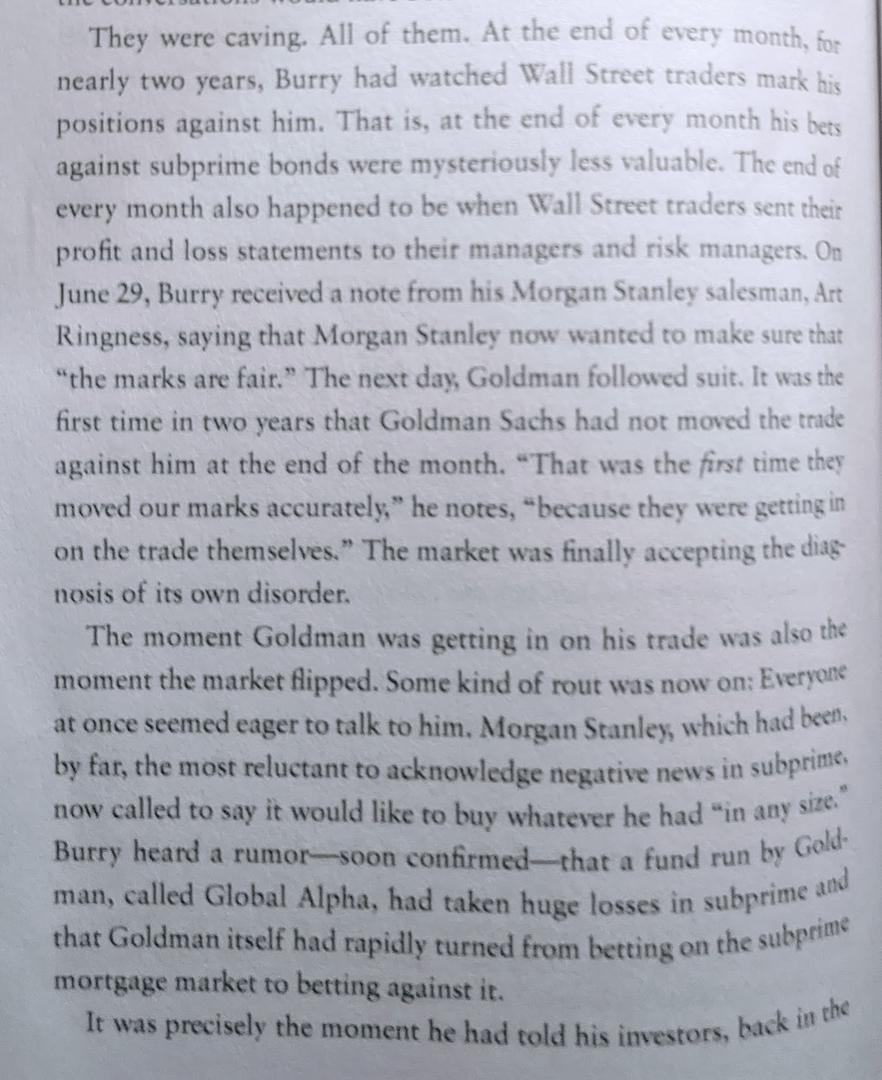

When the bonds he bet against started to fail, they refused to fairly price his positions.

That is, until they finally got in on the trade.

That’s when the floodgates opened up and The Big Short finally paid off.

When the logic behind the inevitable suddenly became undeniable.

I can’t help but notice similarities with #Bitcoin

Now that BlackRock is positioned, prepare for whiplash as the entire marketing apparatus of the world’s largest institutions gets behind BTC.

WordPress’d from my personal iPhone, 650-283-8008, number that Steve Jobs texted me on

https://www.YouTube.com/watch?v=ejeIz4EhoJ0

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO:

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO: