|

||||||||||||||||||||||||

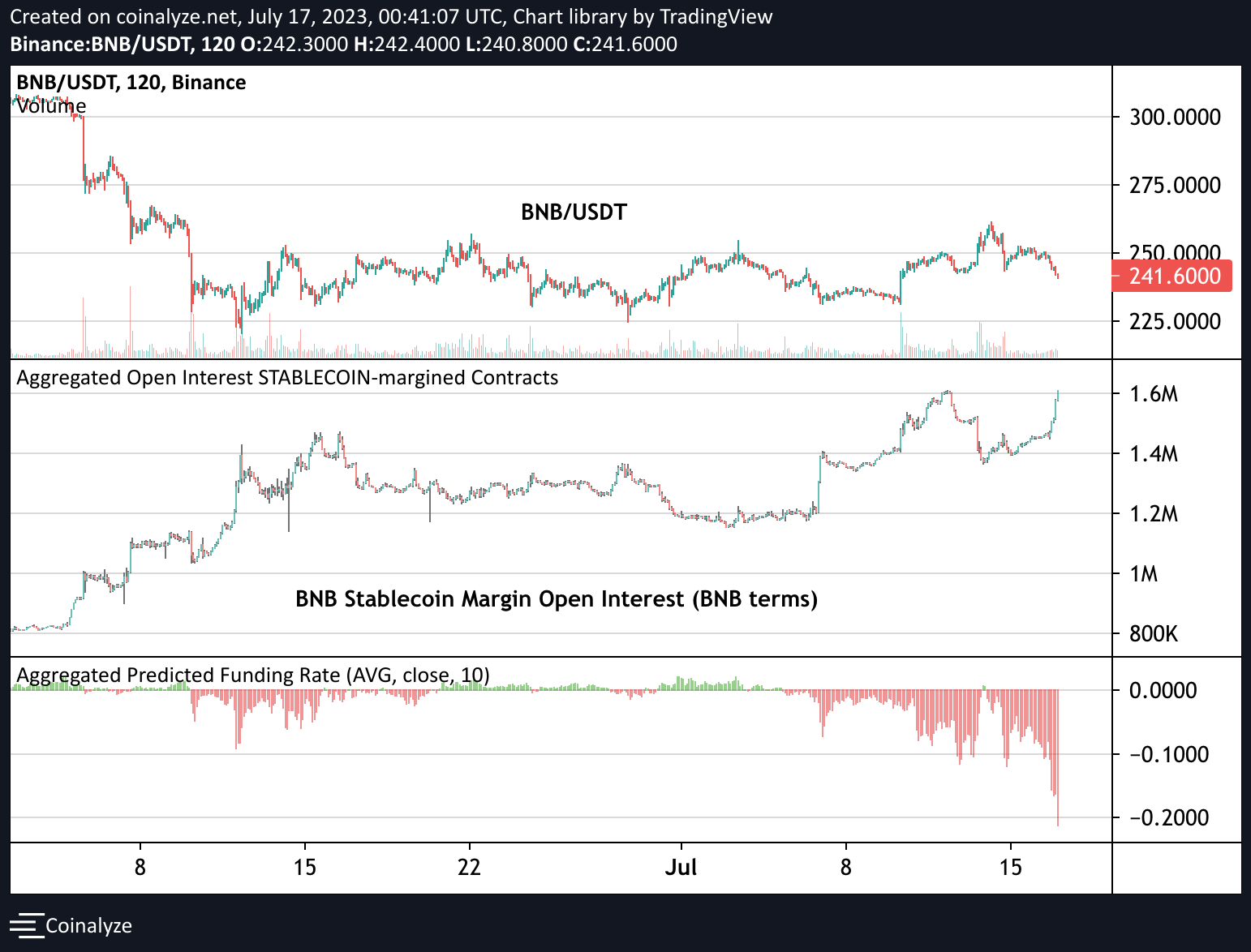

Hmmm, some interesting flow in $BNB futures:

– Perpetual futures open interest is seeing new highs as funding rates have gone deeply negative (-200% APR for next funding period) (Chart #1) – looks as if someone is getting ahead of some bad news flow.

– The last time BNB denominated open interest was this high was December 2020, when price was $30, and funding was extremely positive (Chart #2). In USD terms OI was only ~$50m then, compared to $400m now.

– Interestingly the open interest is not entirely just on Binance any longer. Take a look at BNB open interest NOT on Binance, up only, and surpassing $150 million. Open interest on other platforms is the highest it’s ever been in both relative terms and absolute terms. (Chart #3). It’s a market that’s no longer completely driven on Binance – very notable in my opinion.

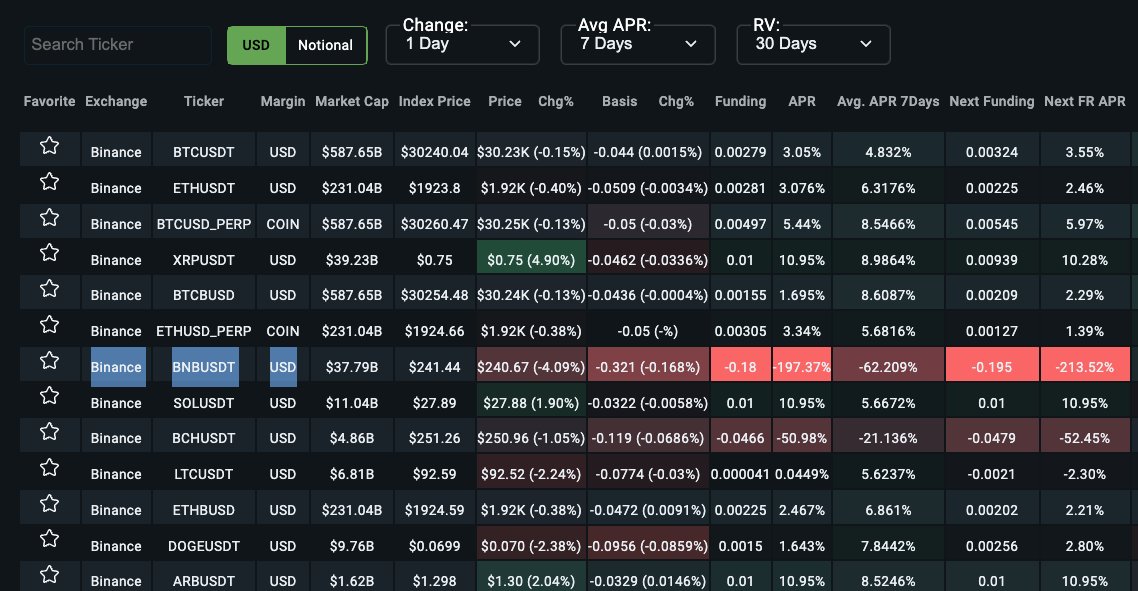

– Lastly, take a look at funding rates on Binance for large cap cryptos… There is an outlier. Traders are getting short BNB and don’t seem to care about the high cost of funding to do so… (Image #4)

Personal hunch is that DoJ charges arrive shortly and people in the know are positioning accordingly, let’s see.

WordPress’d from my personal iPhone, 650-283-8008, number that Steve Jobs texted me on

https://www.YouTube.com/watch?v=ejeIz4EhoJ0

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO:

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO: