What really happened in 2008? (It was NOT a financial crisis)

THREAD🧵👇

Let’s talk about 2008. Often labeled a ‘financial crisis’, it was much more—a monetary meltdown. Forget subprime mortgages; they were just the tip of the iceberg. Here’s a deep dive into what really shook the world and, most of all why it still matters.

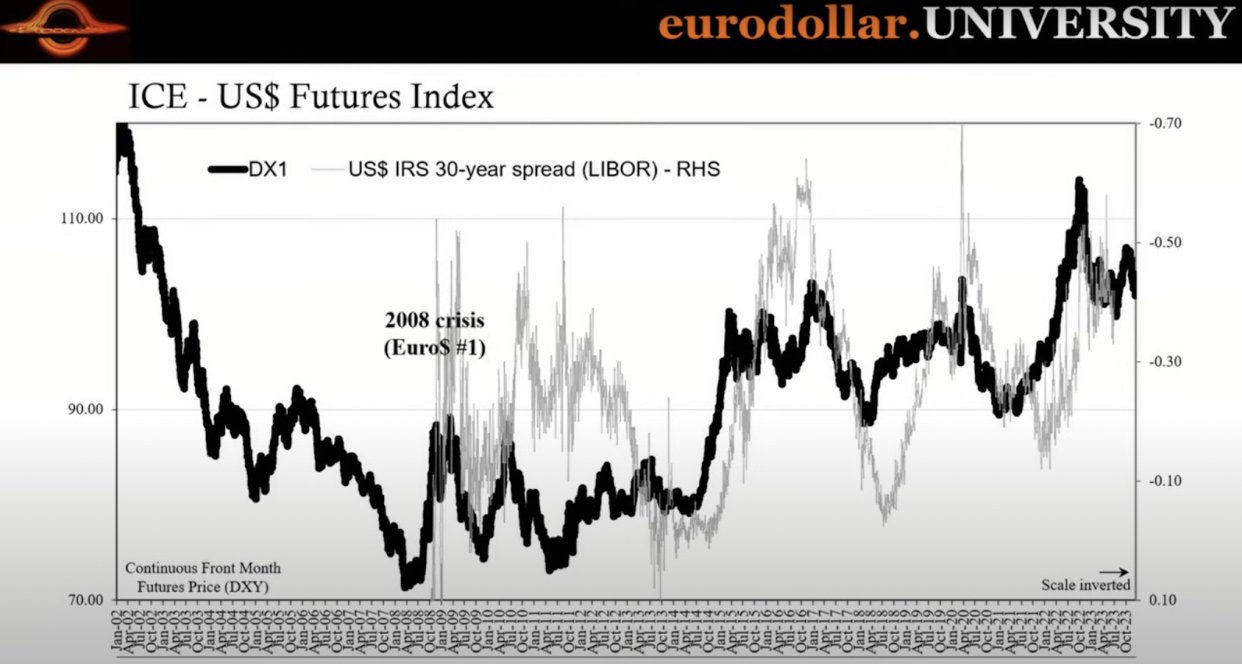

The crisis wasn’t just inflated asset prices going bust. It was about the world running dry on dollars. Think of it not as a wound in the financial system, but as the lifeblood (money) draining out, affecting everything in its path.

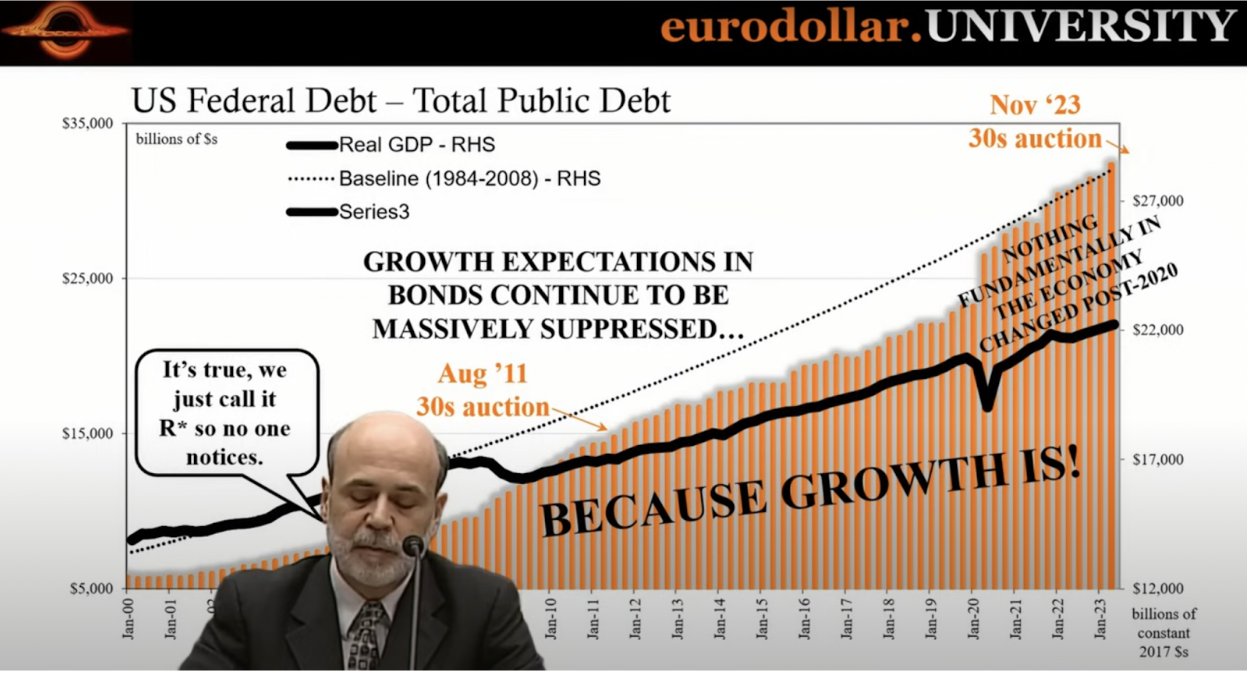

Fast forward 15+ years, and we’re still in the shadow of 2008. It’s not just a memory; it’s a ghost haunting our economy. Think low interest rates are good news? History tells a different story—they are often signs of entrenched economic depression.

2008 was NOT a financial crisis

A financial crisis is when you get an extreme asset bubble and then those crap assets get priced to reality hurting a lot of individ

uals in the process. This is what we saw during the tech bubble (1999) or the S&L Crisis, more recently the crypto bubble (the latest one, anyway).

The 2008 meltdown went way beyond some assets losing value. Even genuinely good assets had to be repriced – lower, of course – because there was no cash to buy them or any others. It’s like having a treasure chest but no key to open it.

Remember the dot-com bubble? The S&L crisis? Why didn’t they trigger global disasters? Because they didn’t involve the monetary system. The 2008 crisis was a storm that dried up the financial ocean, not just rocked a few boats.

The difference is ALL about money

This wasn’t a solo act by the U.S.; it was a global drama. The eurodollar system (virtual dollars flowing around the world mainly outside the U.S.) was the stage where much of the plot unfolded, a detail often missed in mainstream stories.

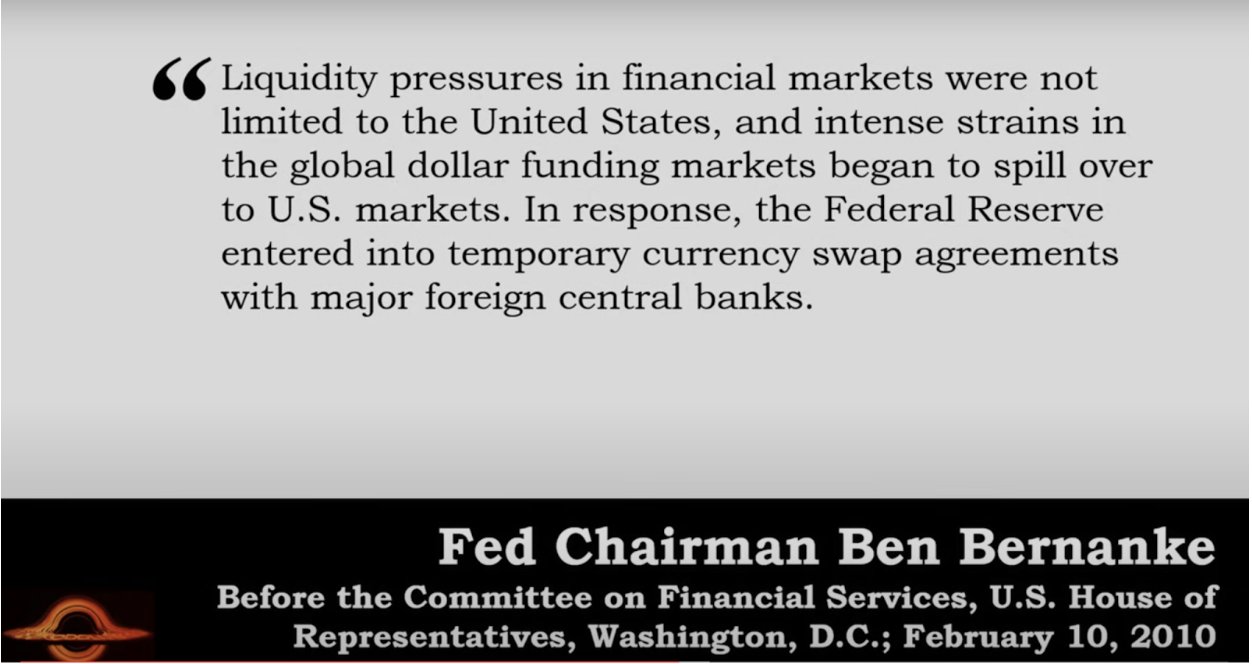

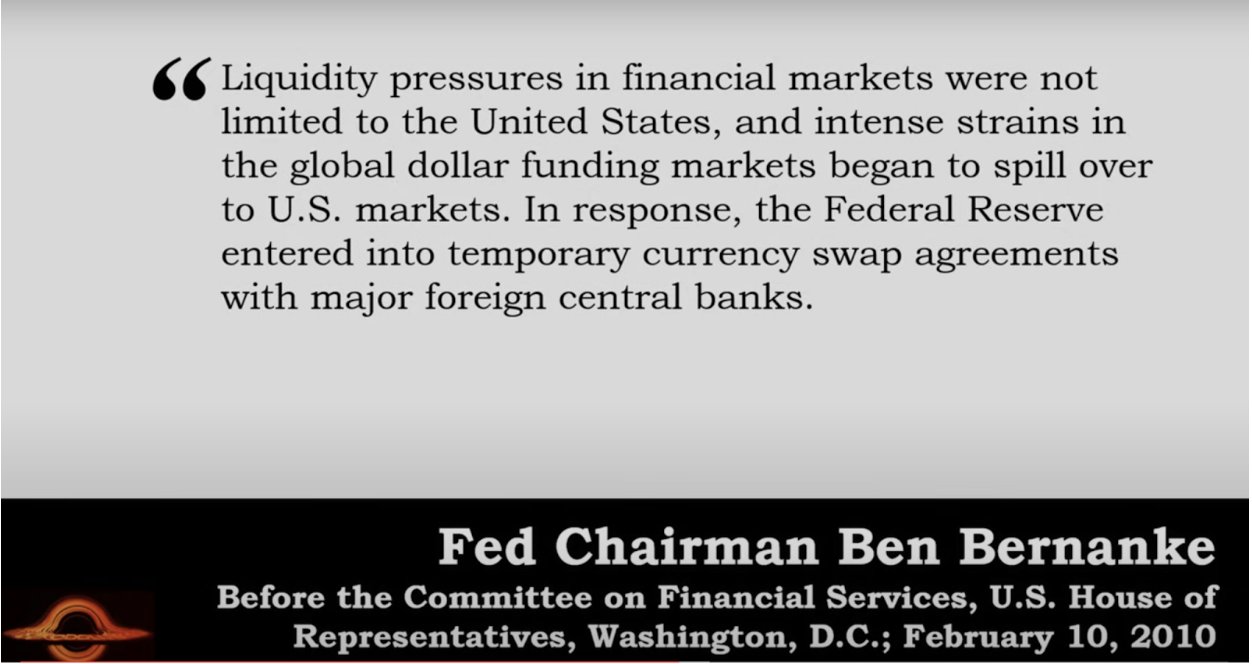

Bernanke’s 2010 words hinted at this bigger picture. It wasn’t just about housing loans going bad; it was a worldwide dollar drought shaking up the global financial scene. It is understandable why the myth of a financial crisis has endured; from the shallowest perspective, it looked a lot like one.

The plot thickened with European banks caught in the eurodollar riptide, leading to a tidal wave of fund outflows. This was beyond bad loans; it was the financial world gasping for liquidity. Monetary circulation throughout the world’s reserve currency plumbing ran suddenly dry.

Enter the repo market – the crisis’ turning point. Collateral once deemed safe became risky, amplifying the initial stage, already dangerous liquidity crisis. It was more than just a market correction; it was a breakdown at the monetary core and there was no coming back from it.

Now, in the 2020s, the echoes of 2008 still linger. The pandemic’s economic shockwaves are riding on the back of this silent monetary depression.

Central bank rate cuts, including those now being openly discussed by central bankers, contrary to popular perception are not just economic tweaks; they’re distress signals, hinting at a return to the gloomy 2010s and its decade-long hangover from a financial mess that spiraled out of control into a full-blown monetary catastrophe.

Even though it was fifteen years ago, we are still living under its shadow – an absolutely critical fact that has gone, and still goes, unappreciated in the rush to pin it as a financial crisis about subprime mortgages. This understanding is crucial as we navigate today’s economic complexities.

If you want to join my newsletter you can here: funnel.eurodollar.university/newsletter

|

||||||||||||||||||||||||

WordPress’d from my personal iPhone, 650-283-8008, number that Steve Jobs texted me on

https://www.YouTube.com/watch?v=ejeIz4EhoJ0

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO:

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO: