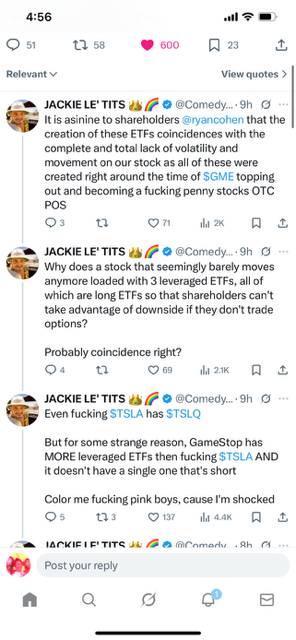

– The thread by @Comedyorwat expresses frustration over GameStop ($GME) attracting three leveraged ETFs—GMEU (2x long daily target, launched April 2025), GMEY (option income strategy), and IGME (covered call, debuted June 2025)—all bullish-oriented with no short equivalents, coinciding with the stock’s prolonged stagnation since mid-2025.

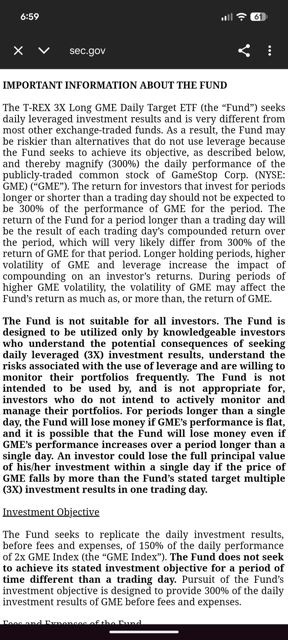

– A fourth ETF, the T-REX 3x Long GME Daily Target, is in SEC filing stages, as shown in the attached image, which highlights risks like compounded volatility decay that can erode value even if $GME rises modestly over time.

– This unusual ETF proliferation for a low-volatility meme stock like $GME, which trades near 2022 levels despite business improvements under CEO Ryan Cohen, suggests Wall Street is hedging bets on renewed retail-driven surges, amplified by the current U.S. government shutdown limiting SEC oversight.

GameStop, a shitty retail stock that was “left for dead” and “no one cares about anymore” somehow now has THREE leveraged ETFs under creation or currently live

Can someone please explain to me how and why $GME has 3 fucking ETFs? it’s fucking ludicrous

$GMEU

$GMEY

$IGME

|

||||||||||||||||||||||||

WordPress’d from my personal iPhone, 650-283-8008, number that Steve Jobs texted me on

https://www.YouTube.com/watch?v=ejeIz4EhoJ0

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO:

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO: