– The post theorizes Michael Burry’s Scion shutdown stems from his view of an AI-fueled bubble, where hyperscalers like Meta and Microsoft inflate earnings by extending server depreciation periods from 2-3 years to 5-6 years, potentially understating $176 billion in expenses through 2028.

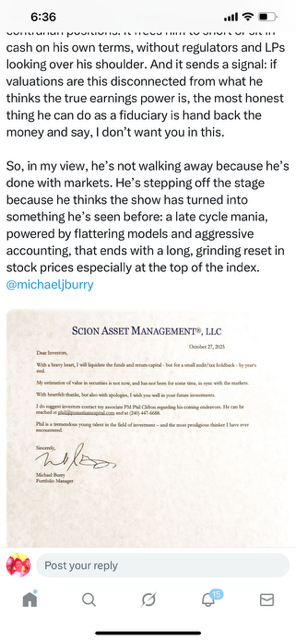

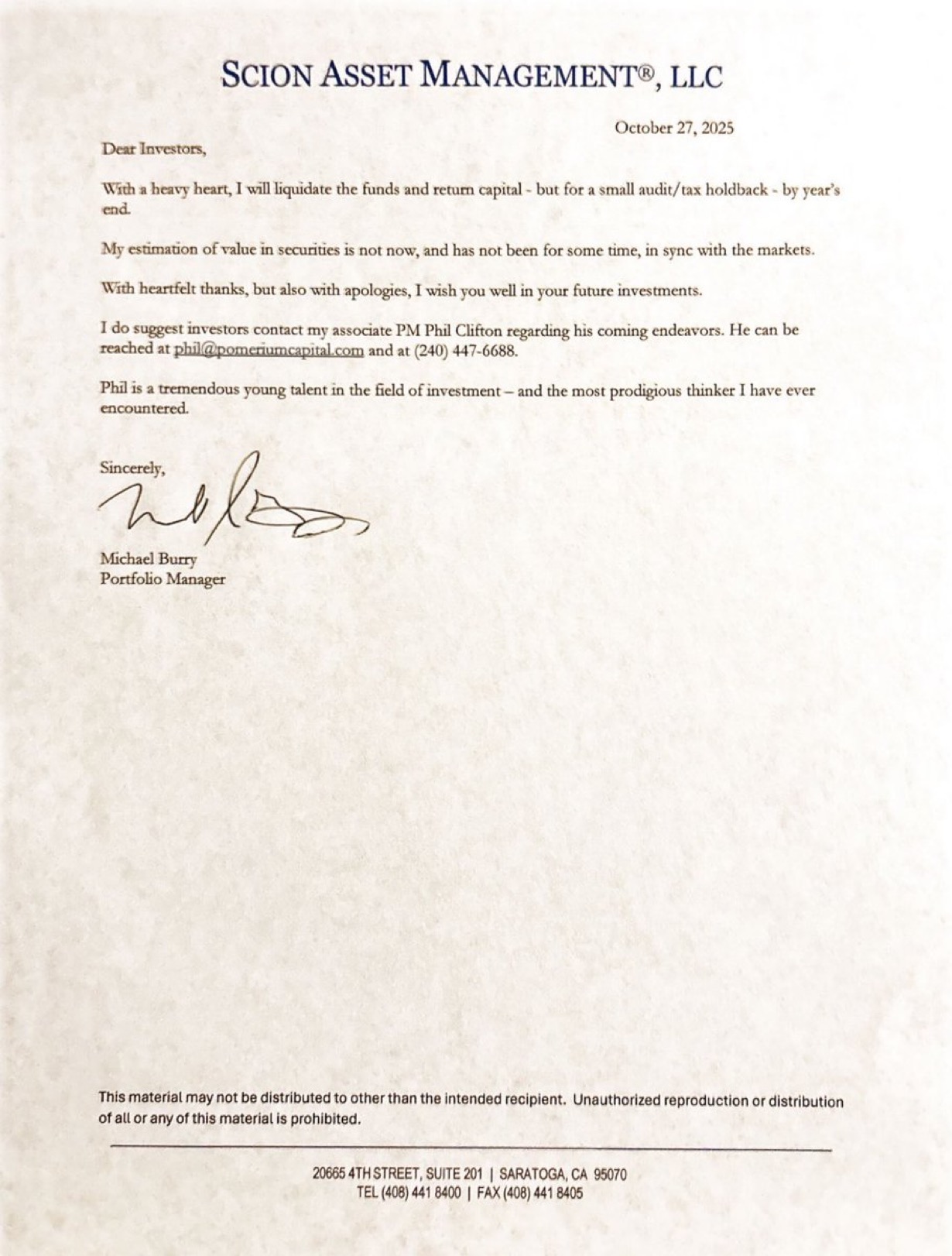

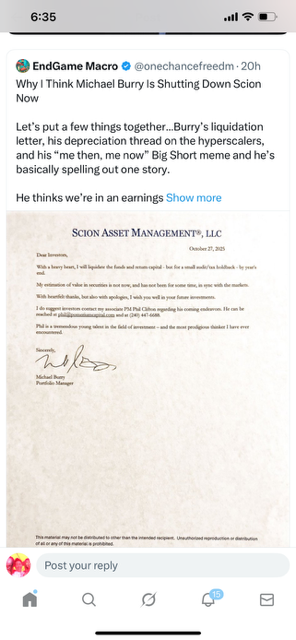

– Burry’s October 27, 2025, liquidation letter explicitly cites misalignment between his security valuations and market prices, echoed in his November posts critiquing accounting practices and invoking his Big Short experience as a parallel to impending repricing.

– Closing the $155 million fund frees Burry from fiduciary constraints, allowing personal positioning against the bubble’s burst—supported by media analyses confirming hyperscalers’ depreciation extensions since 2020, which could reverse AI narrative gains and compress multiples by 2026.

Why I Think Michael Burry Is Shutting Down Scion Now

Let’s put a few things together…Burry’s liquidation letter, his depreciation thread on the hyperscalers, and his “me then, me now” Big Short meme and he’s basically spelling out one story.

He thinks we’re in an earnings inflated, AI driven bubble that a value investor can’t sit inside without eventually getting crushed.

In the letter he says it plainly “My estimation of value in securities is not now, and has not been for some time, in sync with the markets.” That’s not a I’m tired of running money line. That’s a man saying, I can’t reconcile what I see in the numbers with the prices the market is willing to pay. When someone like Burry reaches that point, the logical move isn’t to keep collecting fees and hope it mean reverts. It’s to get out of the structure that forces you to play the game at all.

Then you look at his post on depreciation. He’s saying the biggest beneficiaries of the AI boom that includes META, GOOG, ORCL, MSFT, AMZN of juicing earnings by quietly stretching the useful life of servers and GPU rigs that are really on a 2–3 year technology cycle. Extend the life in the accounting model, and you cut today’s depreciation expense. Cut depreciation, and EPS looks 20–30% higher than it would under a stricter assumption. He’s saying that the market is paying premium multiples on numbers that are, in his view, structurally overstated.

Put that together with the “me then, me now… it worked out, it will work out” post, and he’s clearly casting himself as the same guy who sat in front of a wall of subprime prospectuses in 2005. Back then, he saw engineered AAA paper built on bad collateral. Now he sees trillion dollar market caps built on AI capex and accounting choices he thinks will blow up 2026–2028 as the depreciation math reverses.

SO WHY SHUT DOWN SCION NOW? MY HIGHEST PROBABILITY READ IS THIS

He expects a major repricing in the very stocks that dominate the indices and he doesn’t want to live through the last, craziest stretch of the bubble with other people’s money tied to his name.

If he’s right about the under depreciation, then over the next few years earnings growth for the hyperscalers should slow sharply or even go negative just as the AI narrative cools and the cycle matures. When that happens, multiples compress, passive flows that are overweight those names work in reverse, and the broad market takes a hit because the “Magnificent Few” are the market. From his perspective, that looks less like a normal correction and more like the equity version of the housing unwind: a long stretch of fake comfort, then a sharp break when the math can’t be hidden anymore.

Closing the fund accomplishes a few things at once. It lets him step aside before that break, so he’s not fighting client redemptions or daily benchmarking while he’s trying to hold deeply contrarian positions. It frees him to short or sit in cash on his own terms, without regulators and LPs looking over his shoulder. And it sends a signal: if valuations are this disconnected from what he thinks the true earnings power is, the most honest thing he can do as a fiduciary is hand back the money and say, I don’t want you in this.

So, in my view, he’s not walking away because he’s done with markets. He’s stepping off the stage because he thinks the show has turned into something he’s seen before: a late cycle mania, powered by flattering models and aggressive accounting, that ends with a long, grinding reset in stock prices especially at the top of the index. @michaeljburry

|

||||||||||||||||||||||||

WordPress’d from my personal iPhone, 650-283-8008, number that Steve Jobs texted me on

https://www.YouTube.com/watch?v=ejeIz4EhoJ0

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO:

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO: