|

||||||||||||||||||||||||

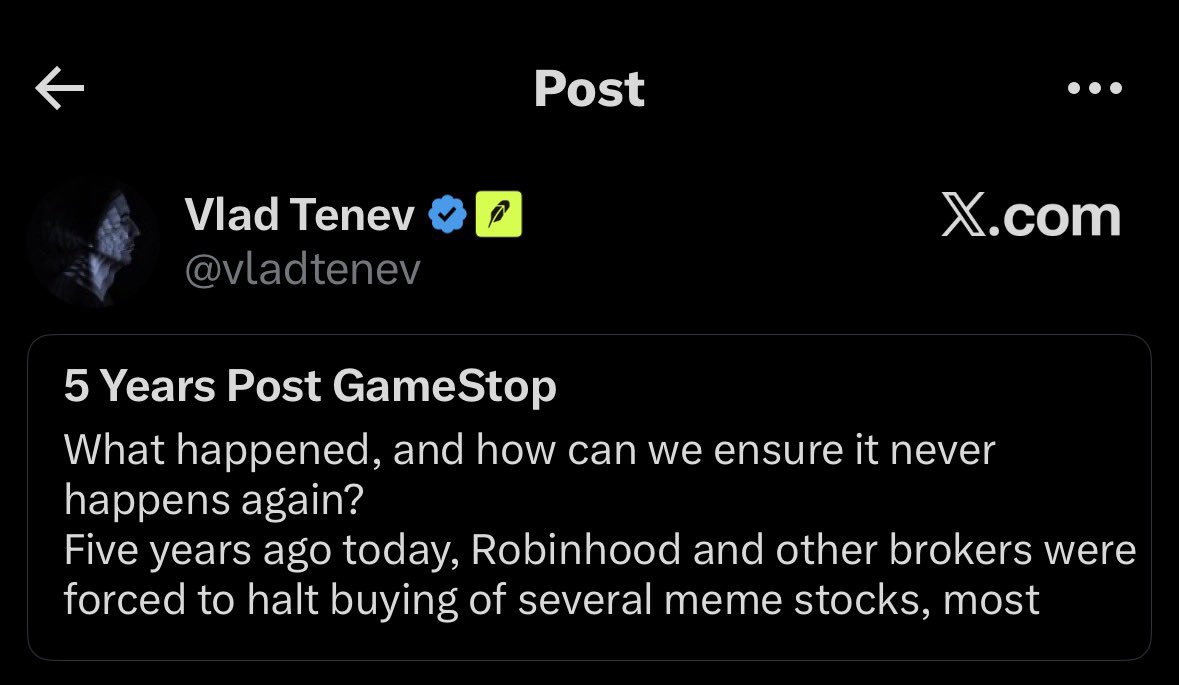

– The post contrasts Vlad Tenev’s reflective anniversary tweet on the 2021 GameStop trading halt—depicted in the attached screenshot—with allegations of synthetic “IOU” shares via payment-for-order-flow, claiming Robinhood owed billions due to unrealized holdings.

– During the January 2021 squeeze, Robinhood restricted buys amid liquidity crunches from clearinghouses, as detailed in SEC reports; no official evidence confirms systemic fake shares, but retail communities widely cite it as naked shorting proof.

– References to Ryan Cohen and GameStop excluding Robinhood shareholders from annual meetings align with GME forum advice to direct-register shares at Computershare for validity, though Cohen’s 2024 meeting transcript mentions holding Robinhood stock without such exclusions.

WordPress’d from my personal iPhone, 650-283-8008, number that Steve Jobs texted me on

https://www.YouTube.com/watch?v=ejeIz4EhoJ0

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO:

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO: