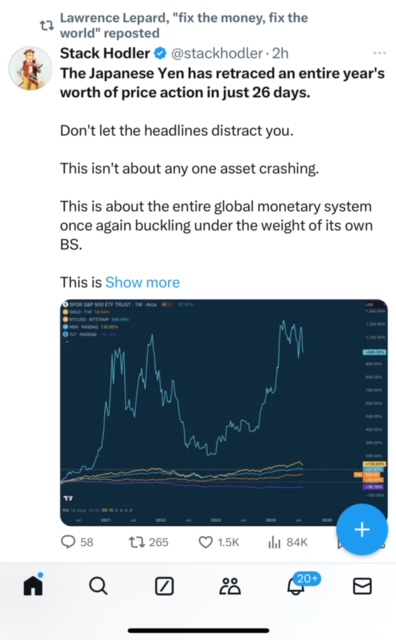

The Japanese Yen has retraced an entire year’s worth of price action in just 26 days.

The Japanese Yen has retraced an entire year’s worth of price action in just 26 days.Don’t let the headlines distract you.

This isn’t about any one asset crashing.

This is about the entire global monetary system once again buckling under the weight of its own BS.

This is about the Bank of Japan pretending they can raise rates without blowing everything up in the process.

The US was already running crisis-level budget deficits…

What happens when portfolio values tank and capital gain tax revenues dry up as a result?

The US deficit goes ballistic and credit markets ultimately seize up as the Federal government floods the market with bonds to pay for deficits.

I’ve been saying it for years on here: The outcome is binary.

And the Central Planners will soon reach their next decision point:

Great Depression 2 or Great Debasement.

Either they let things fall apart, or they print to hold it together.

My bias is towards the Great Debasement, but a portfolio prepared for either scenario will help you watch today’s volatility dispassionately.

My portfolio remains overweight Swiss Francs, BTC, Gold, and crucially, no debt/leverage.

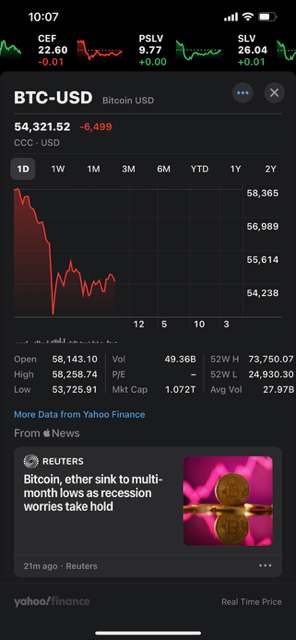

Bitcoin: The best asset to hold through the Great Debasement. Finite bearer money without counter-party risk. It has vastly outperformed every other major asset since the Covid plunge in March 2020 kicked off the last major panic-printing.

Cash: Gains value in the less-likely deflationary scenario and allows you to buy assets that over-leveraged traders sell in a fire sale. It also helps you remain calm during volatility knowing your fiat liabilities (e.g. living expenses) are covered.

Gold: A nice boring physical asset to park some wealth in. Low volatility compared to BTC and equities. Vastly outperforms cash and bonds. And its physical quality provides a different kind of peace of mind (gold holders understand this).

No debt / leverage: Being debt free means never becoming a forced seller. If the monetary authorities lead us down the deflation path (unlikely, but possible) most people with debt will be forced to sell assets (including homes) to cover their obligations. That’s a situation you never want to be in. In that situation you want to be the one with cash buying assets for pennies on the dollar.

The only other piece of the portfolio is a calm and rational mind to weather the volatility.

Days like today should not come as a surprise.

You cannot hide from volatility in the 2020’s.

If the carnage in Japanese markets spills over into US markets, we could be looking at the next March 2020 moment as traders scramble for liquidity by selling whatever assets they hold.

People thought the world was ending in March 2020.

But that was actually just the beginning of a massive bull run.

While many panicked, some of us backed up the truck and bought BTC hand over fist that month and forever changed the trajectory of our families lives in the process.

Will history repeat this time?

If so, we could be closer to the beginning of the next cycle than the end.

All eyes will be on the central planners to see how they react to the carnage.

In the meantime, stay solvent, remain rational, and remember what you own.

And as always, enjoy summer ✌️☀️

|

||||||||||||||||||||||||

https://www.YouTube.com/watch?v=ejeIz4EhoJ0

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO:

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO: