|

||||||||||||||||||||||||

http://www.youtube.com/watch?v=ejeIz4EhoJ0

http://www.youtube.com/watch?v=QXIaNZi3mHQ

What A Super Model Can Teach a Harvard MBA About Credit www.slideshare.net/larrychiang/what-a-super-model-can-teach-a-harvard-mba-about-credit

American Express hosts me mentoring you about FICO scores at New York Fashion Week

t.co/inxTmZAj

My video boils down 20,000 hours and moves you to the right on the entrepreneur bell curve

http://www.youtube.com/watch?v=eudADPfTWiE

whattheydontteachyouatstanfordbusinessschool.com/blog

CNN Video Channel: ireport.cnn.com/people/larrychiang

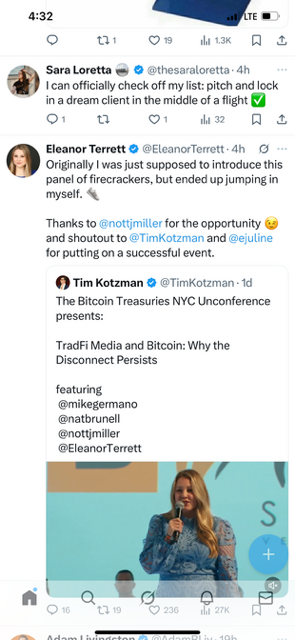

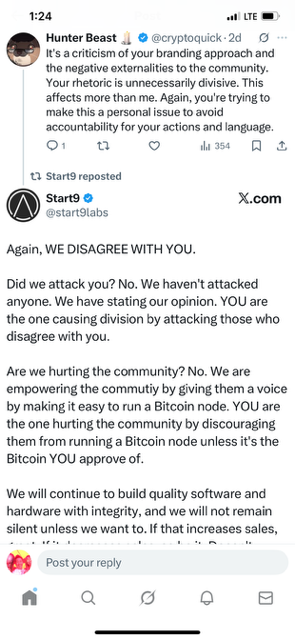

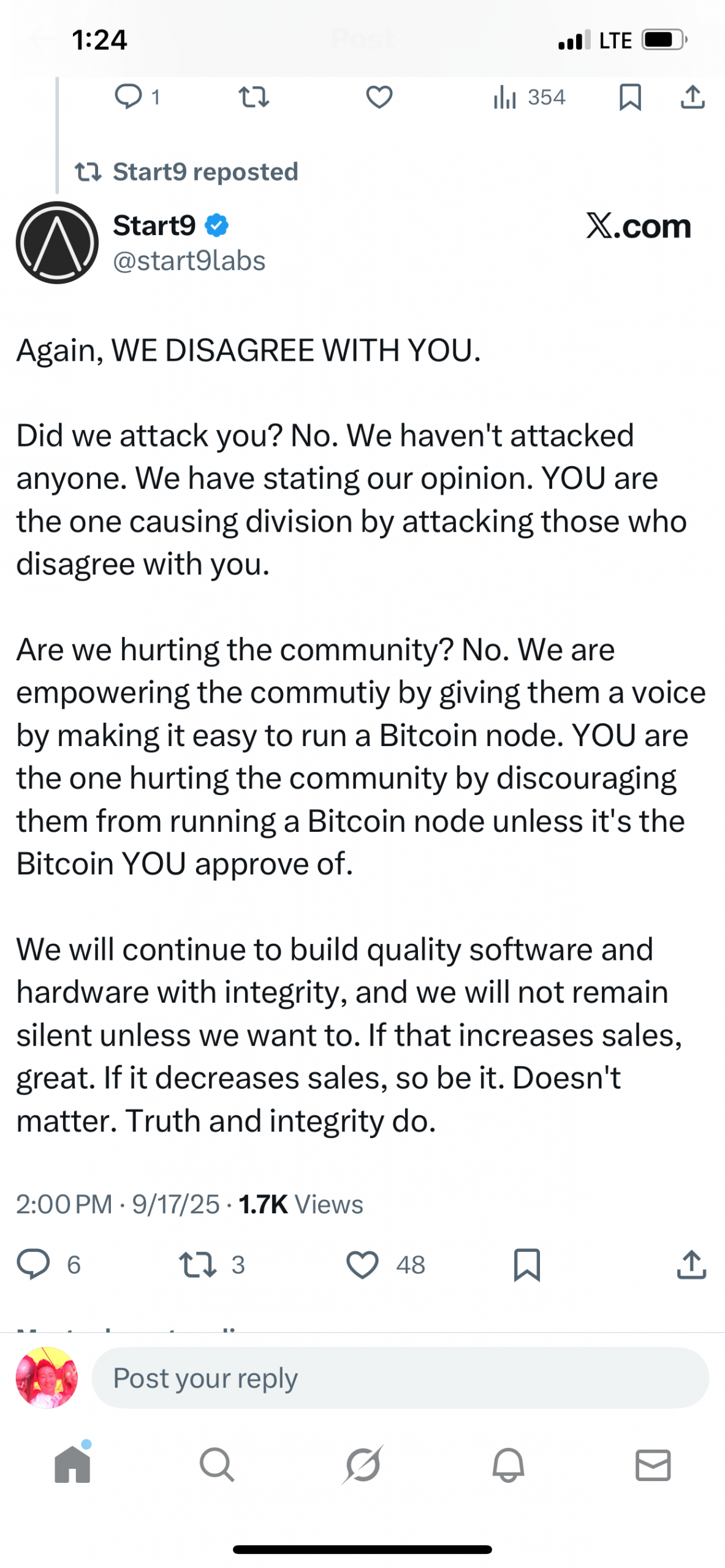

Read my last 10 X posts at www.X.com/LarryChiang

Author of #WTDTYASBS a NY Times Bestseller released 09-09-09 at #NYFW on a runway under the tents

whattheydontteachyouatstanfordbusinessschool.com/blog/?s=Ny+times+bestseller

www.fastcompany.com/embed/c0d4562ea2049

52 Cards. Two Jokers. What They DO Teach You at Stanford Engineering

http://www.youtube.com/watch?v=vDBY0GkI3-g

Emergency swings and cutting deals as an 9 year old

http://www.youtube.com/watch?v=OFGY7v9C4G0

Hunter Pence shared thoughts before winning WORLD SERIES’ Game #7

http://www.youtube.com/watch?v=usu0luYy9pw

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO:

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO: