Bitcoin fans from University of Illinois and Harvard

Bitcoin fans from University of Illinois and Harvard

|

||||||||||||||||||||||||

FASB adopts ‘fair value accounting’ for bitcoin

FASB adopts ‘fair value accounting’ for bitcoin

|

||||||||||||||||||||||||

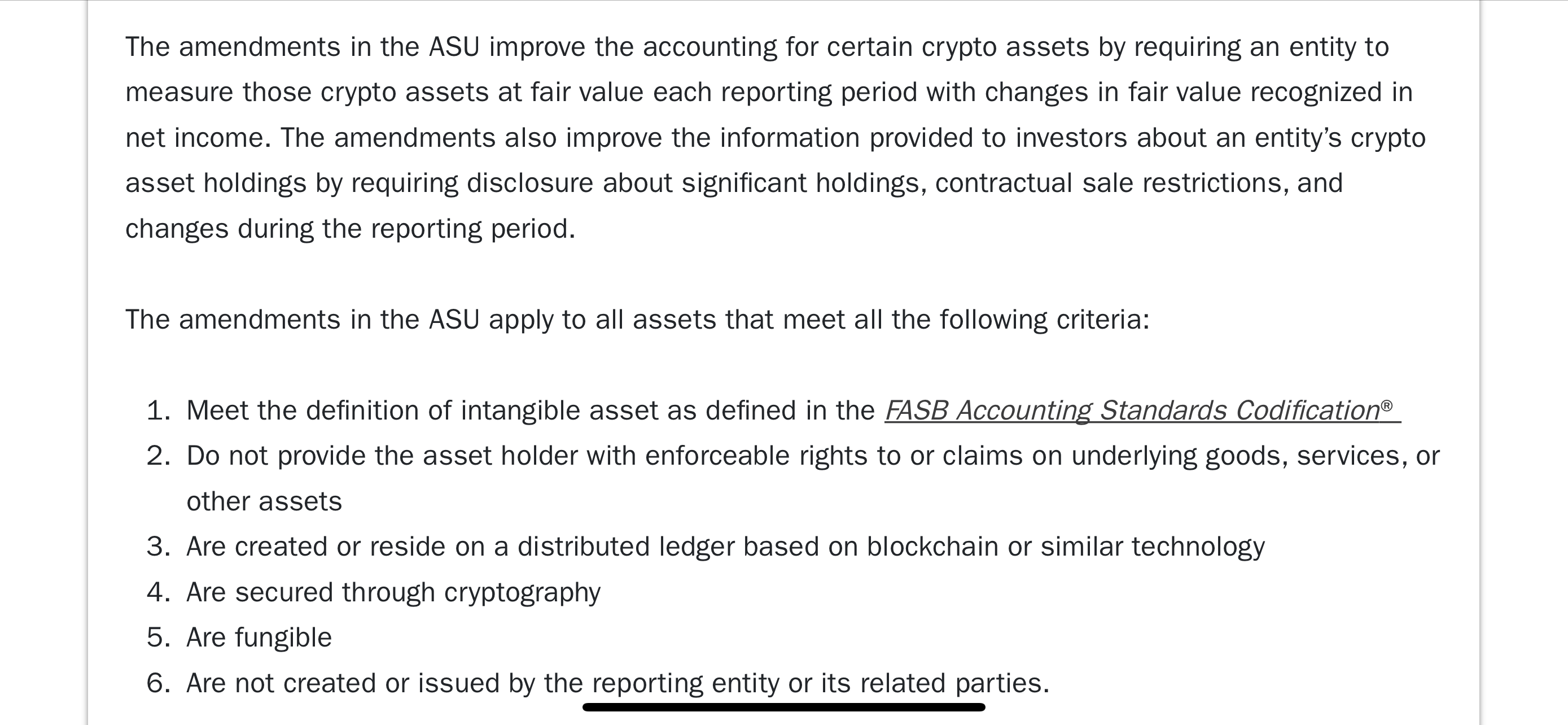

Let’s break down what the adoption of Fair Value Accounting for #Bitcoin by the Financial Accounting Standards Board (FASB) means👇

👉Fair Value Accounting: This method involves assessing assets and liabilities at their current market value, rather than their historical cost. For Bitcoin, this means its value on financial statements will reflect real-time market prices.

👉Impact on Corporate Adoption of #BTC : This change in accounting standards could make it more attractive for corporations to hold Bitcoin as a treasury reserve asset. Under Fair Value Accounting, Bitcoin’s volatile price changes will be directly reflected in financial reporting, providing a more accurate picture of its value as an asset.

👉Facilitating Wider Adoption: With this change, corporations worldwide might be more inclined to include Bitcoin in their financial strategies. The ability to account for Bitcoin at its fair value could make financial statements more transparent and reflective of current market conditions.

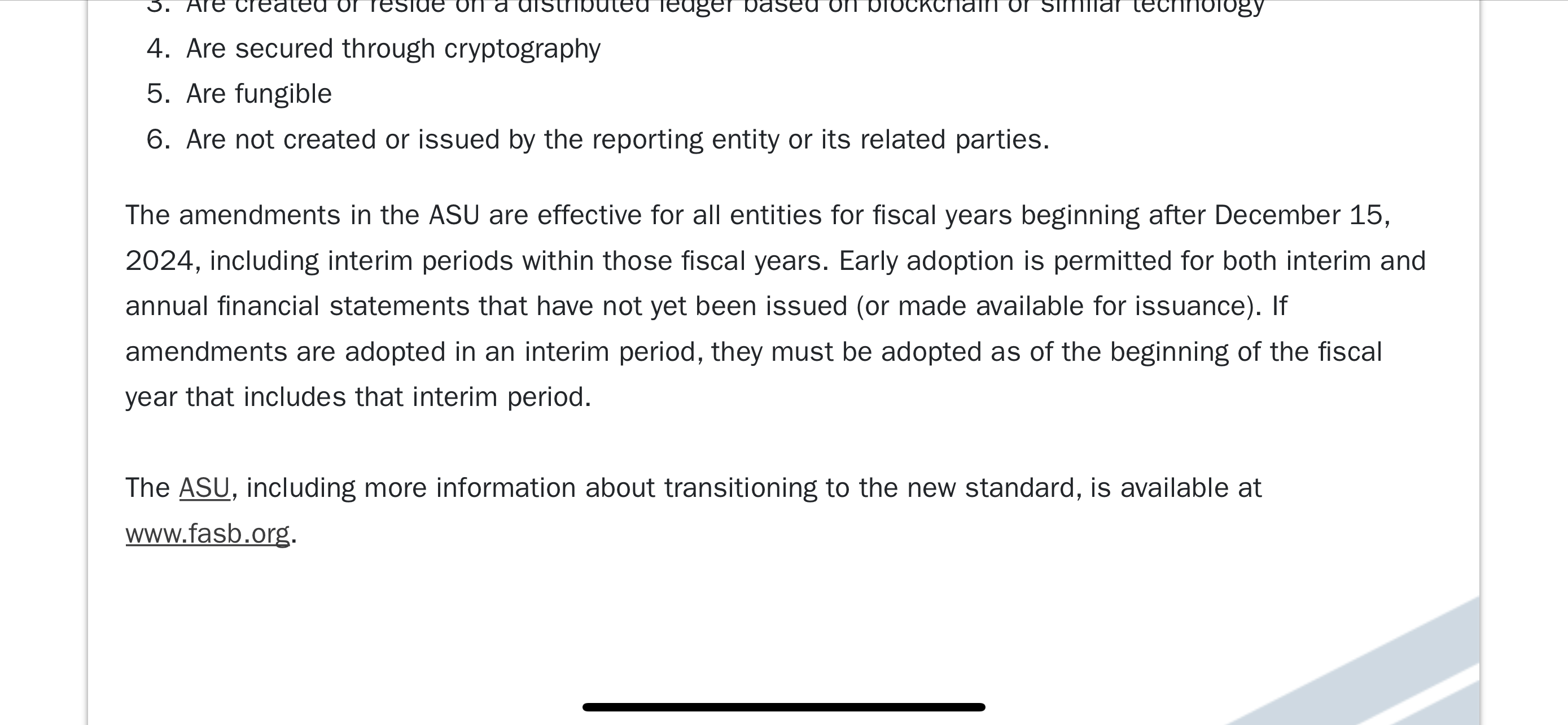

👉Starting in Fiscal Year 2024: The new standard will be applicable for fiscal years beginning after December 15, 2024. This gives corporations time to adjust their accounting practices and strategies accordingly.

👉Bitcoin as a Mainstream Financial Asset: This move by the FASB is a significant step towards the mainstream acceptance of Bitcoin as a legitimate financial asset in corporate finance, acknowledging its growing relevance in the global financial system.💪

In essence, this decision by the FASB is a recognition of Bitcoin’s increasing prominence and could pave the way for broader corporate investment in Bitcoin and cryptocurrencies. 🥳

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

WordPress’d

https://www.YouTube.com/watch?v=ejeIz4EhoJ0

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO:

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO: