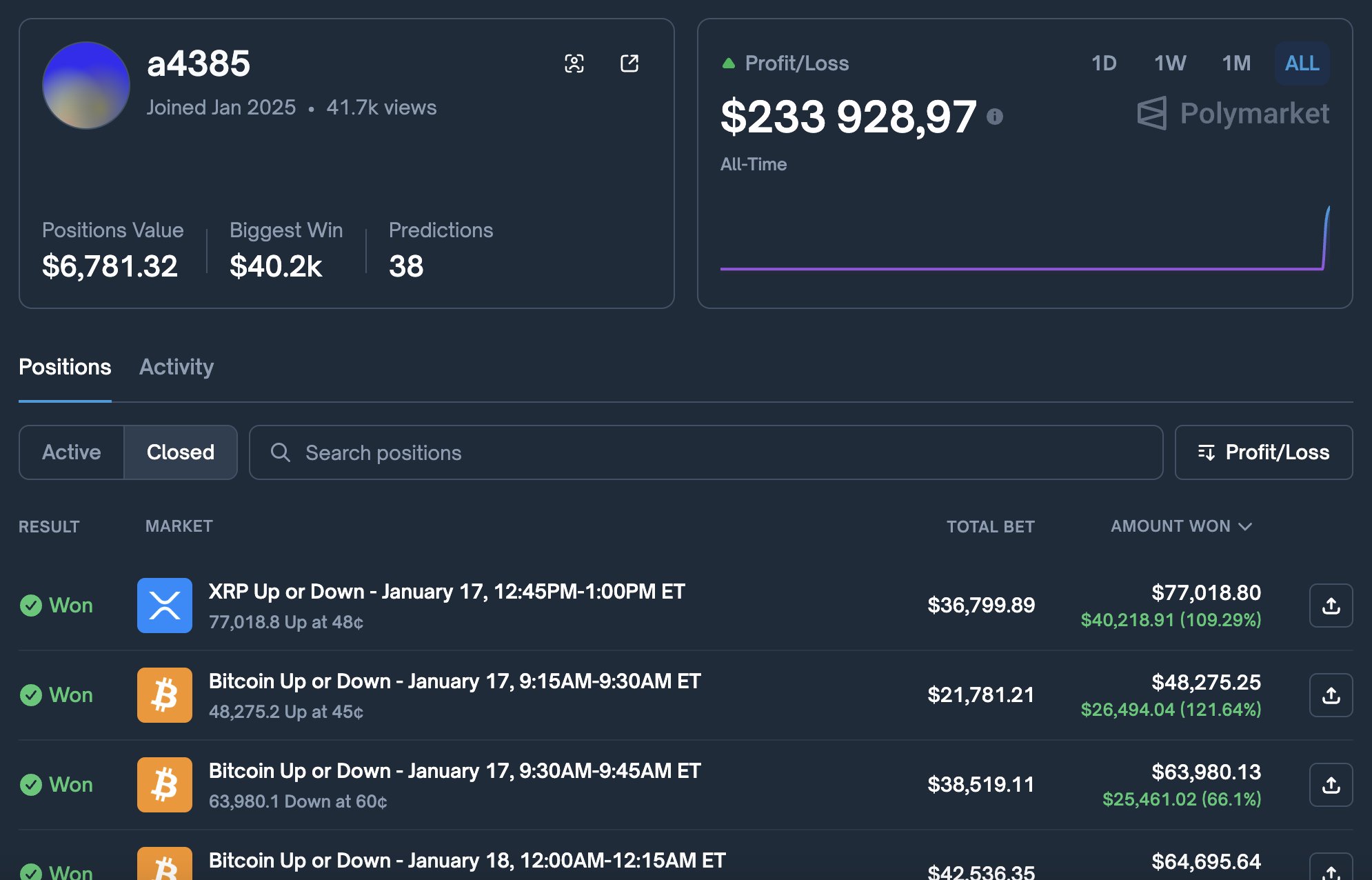

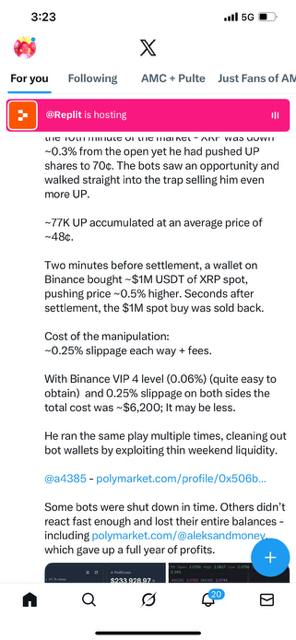

– A Polymarket trader (@a4385) netted $233,929 in profits across five 15-minute XRP and Bitcoin up/down markets by accumulating cheap “UP” shares during thin weekend liquidity, then spiking spot prices on Binance with $1M USDT buys just before settlement to ensure wins.

– The strategy exploited trading bots that sold “UP” shares at inflated prices (up to 70¢ despite XRP down 0.3% initially), costing the trader only ~$6,200 in slippage and fees per trade, as shown in position screenshots revealing average costs of 45-60¢ per share.

– This “Wolf of Wall Street”-style play drained bot liquidity pools, prompting shutdowns and exposing risks in automated market making on prediction platforms, with community reactions praising the ingenuity while highlighting broader manipulation concerns in crypto derivatives.

|

||||||||||||||||||||||||

WordPress’d from my personal iPhone, 650-283-8008, number that Steve Jobs texted me on

https://www.YouTube.com/watch?v=ejeIz4EhoJ0

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO:

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO: