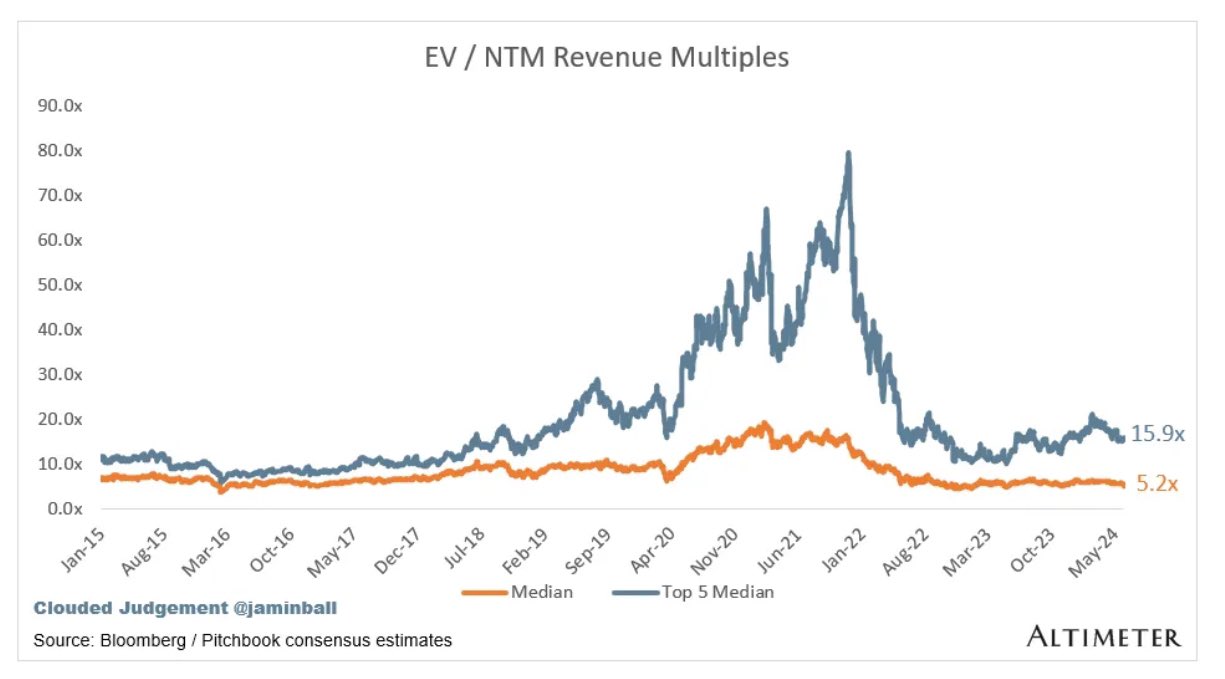

Was at a VC dinner last night where the main topic was the max divergence of public multiples (now 5.2x fwd EV in software and 15.9x for top cos) vs private VC multiples. In AI land we’re back at 2021-era 100x multiples, this time without the elevated public comps. Growth funds are modeling time to “breakeven” from multiple compression at over 2 years with even the most optimistic company forecasts. While there will likely be some number of new generational companies built this cycle, many funds will likely lose $ in the hype, as they had in the 2021 cycle. What will happen from here?

Was at a VC dinner last night where the main topic was the max divergence of public multiples (now 5.2x fwd EV in software and 15.9x for top cos) vs private VC multiples. In AI land we’re back at 2021-era 100x multiples, this time without the elevated public comps. Growth funds are modeling time to “breakeven” from multiple compression at over 2 years with even the most optimistic company forecasts. While there will likely be some number of new generational companies built this cycle, many funds will likely lose $ in the hype, as they had in the 2021 cycle. What will happen from here?– VC consolidation will continue but slowly. As 2021 era investments eventually become marked to mkt, LP allocations to VC will continue to adjust to pre-2021 era. A couple “index” funds may continue to accumulate capital but otherwise selection and discipline (and ability to invest in the long-term winners) will separate returns

– AI multiples will remain high. In many cases AI companies are raising large rounds because they are demonstrating remarkably fast revenue and user growth. However, retention remains a leading indicator of which products may reach true PMF (eg it is actually helping people do something 10x faster / cheaper / better) vs which are enjoying AI novelty. As soon as a company’s growth declines from 2-3x to <50% many will struggle to raise a next round at such a high watermark. Understandably many are stockpiling funds while they can now

– As we’ve seen from WWDC, in many use cases, incumbents are the largest threat and most likely long-term winner. The M&A market unlocking (post elections) would be a big positive for VC DPIs

|

||||||||||||||||||||||||

WordPress’d from my personal iPhone, 650-283-8008, number that Steve Jobs texted me on

https://www.YouTube.com/watch?v=ejeIz4EhoJ0

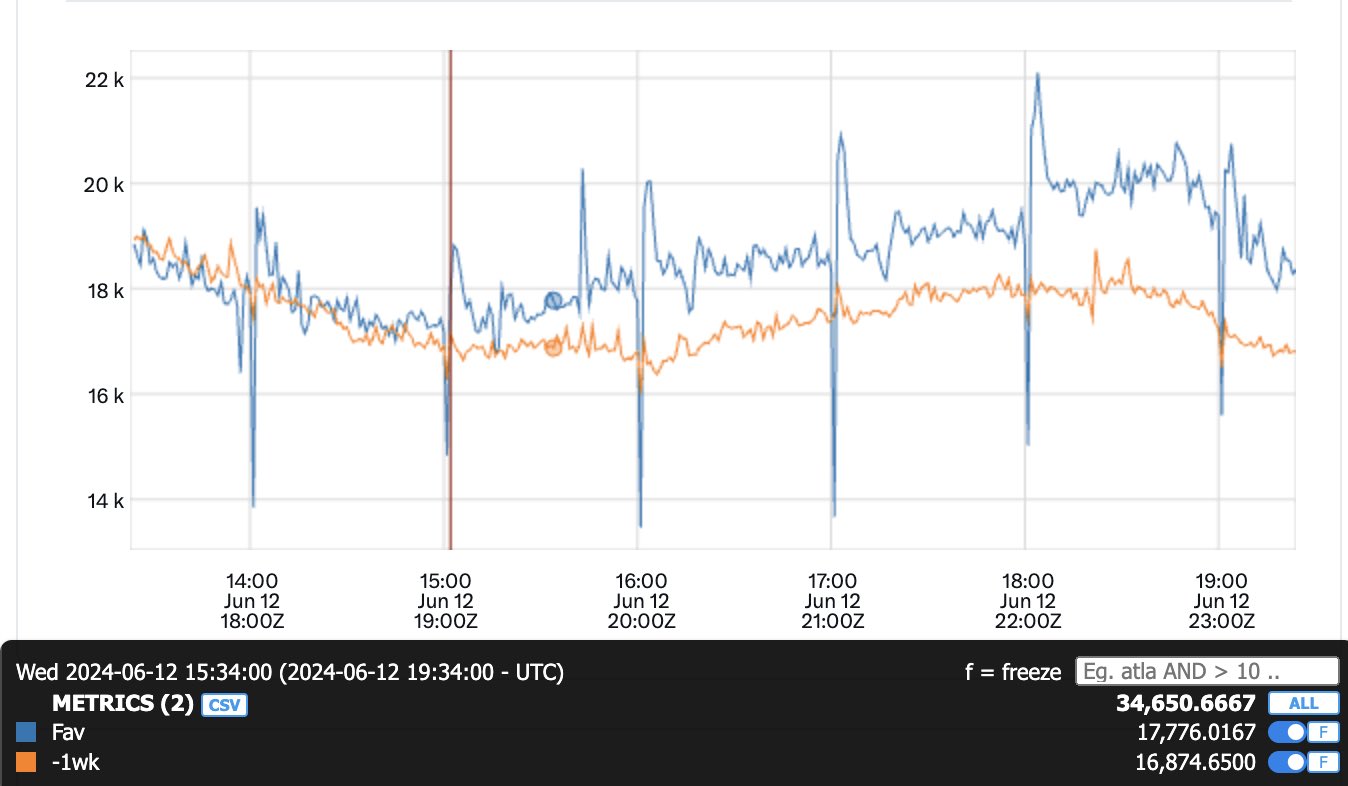

max divergence of pubic likes

max divergence of X post favoriting❤️

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO:

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO: