Micro strategy Stock compression multiple theorem

GameStop multiple of net assets during 2021’s short squeeze was 49x. This is representative of the compression of low float illiquidity

MicroStrategy is exactly is experiencing this in epic proportion). The forced buy side volume (shorts and passive investors) coupled with VERY STRONG diamond hand retail & passive investors resulted in compression and volatile price discovery to the upside.

$MSTR is currently trading at 1.2 ish x net assets. Idiot traders will trade based off this value, but will miss gains to the upside bigly (same fallacy as buying back in lower with #BTC , but magnified – aka leverage)

On the low end, I anticipate $MSTR to trade somewhere near the multiple of net assets traded in 2021 (~4x). More retail traders, more understanding of #Bitcoin , bullish sentiment, etc.

I’ve seen this movie before

Here is an example of MSTR trading relativities in Feb of 2021 & what that would it could look like in 2025:

Feb 12 21 $MSTR:

Stock price: $1,034

Owned 91,064 #Bitcoin

$48,662 #BTC price in Feb ‘21

$4.43B of assets (a)

$2b of debt (b)

2.43B = net asset value (a-b)

$10B market cap

4x net asset value in Feb 12 of ‘21

Jan 2025 price example:

#BTC price: $250,000 (c)

$MSTR #BTC holdings : 200,000 (d)

$MSTR asset value: $50B (c*d)

debt: $3B

net assets: $47B

AT MINIMUM peak compression multiple in ‘21 of 4x

MSTR net assets ($47B)*4 = $188B market cap

Share float ~ 17M

Estimated $MSTR share price @ Min = $11,058

$GME compression multiple example: 49x net assets

$47B * 49 = $2.3 T market cap

Divided by 17M share float = $135,470 share price

We are going to witness never before seen price discovery if #Bitcoin goes as parabolic as @Excellion & @adam3us & @supplyshocks argue.

My reason for “compression multiple theory” is a function of the proportion of passive investors in a publicly traded stock, and frequency changes in allocations to represent associated indexes. These investors do not move, just compress the remaining shares available to make price discovery a function of the few remaining shares that are liquid.

In 2021 $GME could be manipulated by bad actors in the hedge fund / financial world. Those same bad actors &/or short sellers won’t be able to control $MSTR. Imagine “shutting down trading” to $MSTR when the price of #Bitcoin tears peoples faces off to the upside (just like they did with $GME) to shake out paper hands (like myself). $MSTR will open higher if the assets the company holds continues to rip. Initiate #Bitcoin Black hole that causes market mayhem.

Short sellers are going to be chasing their assholes in to the red candle from hell and will likely destroy (re-distribute) multi-generational wealth and take down the entire US banking system.

This is like the scene in the big short where Brad Pitt yells at the young investors in the casino (link: youtu.be/0k5aVLi_yhM?si…)

Success in this trade means a very different / rough / tumultuous world shifting with extreme volatility disrupting the fabric of a lot of society as we know it. Government, Real estate, banking, surveillance, education, insurance, AI, etc.

This is a very serious trade, do not take that responsibility lightly. This is also why @saylor appears so serious all the time, he understands the gravity of this situation, and he has game theoried the way to the proverbial black hole finish line. The gravity of $MSTR & #BTC will consume everything around it.

|

||||||||||||||||||||||||||||

WordPress’d

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

$MSTR stock float compression multiple theory (designed by me). A 🧵

$GME multiple of net assets during ‘21 short squeeze was 49x. This is representative of the compression of low float illiquidity (exactly what is happening to $MSTR in epic proportion). The forced buy side volume (shorts and passive investors) coupled with VERY STRONG diamond hand retail & passive investors resulted in compression and volatile price discovery to the upside.

$MSTR is currently trading at 1.2 ish x net assets. Idiot traders will trade based off this value, but will miss gains to the upside bigly (same fallacy as buying back in lower with #BTC , but magnified – aka leverage)

On the low end, I anticipate $MSTR to trade somewhere near the multiple of net assets traded in 2021 (~4x). More retail traders, more understanding of #Bitcoin , bullish sentiment, etc.

Here is an example of MSTR trading relativities in Feb of 2021 & what that would it could look like in 2025:

Feb 12 21 $MSTR:

Stock price: $1,034

Owned 91,064 #Bitcoin

$48,662 #BTC price in Feb ‘21

$4.43B of assets (a)

$2b of debt (b)

2.43B = net asset value (a-b)

$10B market cap

4x net asset value in Feb 12 of ‘21

Jan 2025 price example:

#BTC price: $250,000 (c)

$MSTR #BTC holdings : 200,000 (d)

$MSTR asset value: $50B (c*d)

debt: $3B

net assets: $47B

AT MINIMUM peak compression multiple in ‘21 of 4x

MSTR net assets ($47B)*4 = $188B market cap

Share float ~ 17M

Estimated $MSTR share price @ Min = $11,058

$GME compression multiple example: 49x net assets

$47B * 49 = $2.3 T market cap

Divided by 17M share float = $135,470 share price

We are going to witness never before seen price discovery if #Bitcoin goes as parabolic as @Excellion & @adam3us & @supplyshocks argue.

My reason for “compression multiple theory” is a function of the proportion of passive investors in a publicly traded stock, and frequency changes in allocations to represent associated indexes. These investors do not move, just compress the remaining shares available to make price discovery a function of the few remaining shares that are liquid.

In 2021 $GME could be manipulated by bad actors in the hedge fund / financial world. Those same bad actors &/or short sellers won’t be able to control $MSTR. Imagine “shutting down trading” to $MSTR when the price of #Bitcoin tears peoples faces off to the upside (just like they did with $GME) to shake out paper hands (like myself). $MSTR will open higher if the assets the company holds continues to rip. Initiate #Bitcoin Black hole that causes market mayhem.

Short sellers are going to be chasing their assholes in to the red candle from hell and will likely destroy (re-distribute) multi-generational wealth and take down the entire US banking system.

This is like the scene in the big short where Brad Pitt yells at the young investors in the casino (link: youtu.be/0k5aVLi_yhM?si…)

Success in this trade means a very different / rough / tumultuous world shifting with extreme volatility disrupting the fabric of a lot of society as we know it. Government, Real estate, banking, surveillance, education, insurance, AI, etc.

This is a very serious trade, do not take that responsibility lightly. This is also why @saylor appears so serious all the time, he understands the gravity of this situation, and he has game theoried the way to the proverbial black hole finish line. The gravity of $MSTR & #BTC will consume everything around it.

|

||||||||||||||||||||||||||||

https://www.YouTube.com/watch?v=ejeIz4EhoJ0

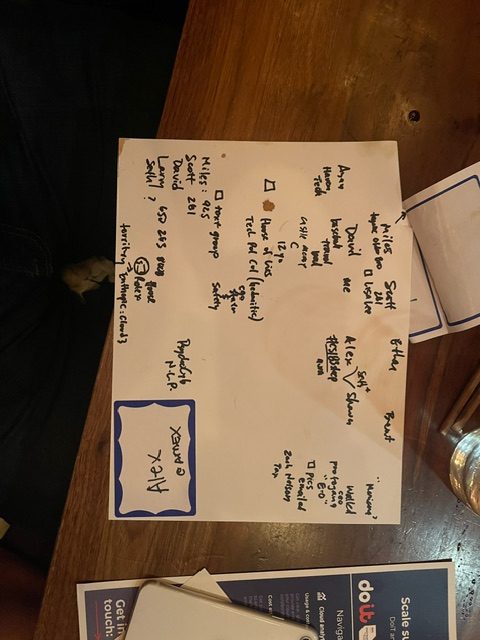

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO:

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO: