|

Larry Chiang (@LarryChiang) |

|

I am advising #SayingNoToVc at least 11-20x before you later say yes

cc: @marcusnelson #sxsw. |

|

When you NEED the money, do not pitch VC. Sound familiar!? If you need cash, do not use your credit card. Let me repeat, don’t pitch VCs if it’s your first startup

|

Marcus Nelson (@marcusnelson) |

|

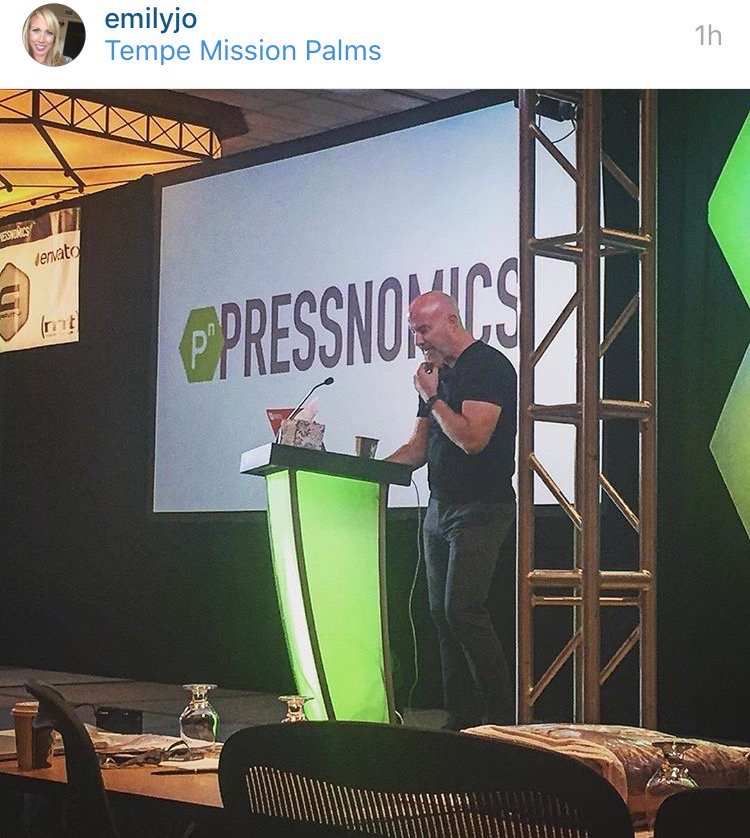

My wife @emilyjo captured my @PressNomics talk on #SayingNoToVc #UnlessYourCompanyIsCrazySuccessful pic.twitter.com/mElB5ZPqKz

|

|

Marcus Nelson, founder of Addvocate

|

Larry Chiang (@LarryChiang) |

|

My mentees say #SayingNoToVc 11-15x before we say yes.

#LaunchFestival cc @marcusnelson #sxsw twitter.com/mtkinji/status… |

|

House money comes after you say no 11-15x. House money is the concept within treasure management where we are not under the gun. Taking VC before saying “No” by definition is being ‘under the gun’. For example, the VCs that funded you now may fire you. Another example is that you lose board of director control.

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO:

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO: