A Duck9 Exclusive

|

||||||||||||||||||||||||

The Pitfalls of Miscalculating Credit Card Rewards: A Lesson in Digital Credit Knowledge

Unedited by Larry Chiang

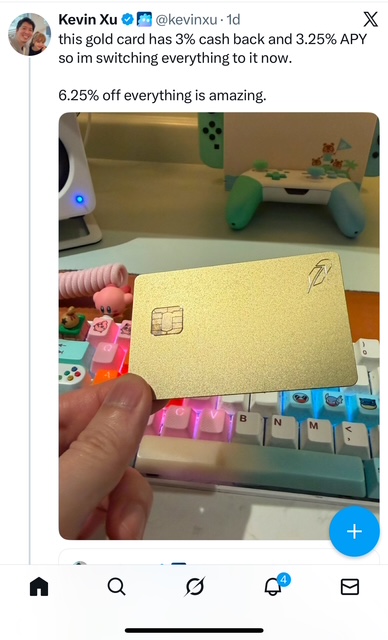

In an era where financial influencers command massive audiences on social media platforms like X (formerly Twitter), the spread of misleading advice about credit cards and rewards can have significant consequences for everyday consumers. A recent viral post by Kevin Xu, CEO of Alpha AI and a prominent finance tracker with a self-reported net worth exceeding $11 million, exemplifies this issue.

Kevin Xu enthusiastically announced his switch from the Apple Card to Robinhood’s Gold Card, touting a combined “6.25% effective discount” on purchases by adding the card’s 3% flat cash back to a 3.25% APY on brokerage cash. This claim, however, reveals a fundamental misunderstanding of how rewards and interest actually compound, underscoring the critical need for what credit expert Larry Chiang has long termed “digital credit knowledge”—the deep, underground understanding of credit systems that empowers individuals to navigate modern financial products wisely and avoid costly errors.

To appreciate the flaw in Xu’s calculation, one must first examine the mechanics of the cards in question. The Apple Card offers straightforward rewards: typically 2% cash back on most purchases (with 3% on Apple products and select partners) and a high-yield savings account currently yielding around 3.65% APY. In contrast, the Robinhood Gold Card, available only to subscribers of Robinhood Gold (a $5 monthly or $50 annual service), provides an unlimited 3% cash back on all categories and 5% on travel booked through their portal, with no annual fee beyond the subscription. Rewards can be redeemed as cash, deposited into a brokerage account, or invested. Robinhood also offers competitive interest on uninvested cash, though rates fluctuate—recently around 3-5% depending on market conditions and Gold status.

Xu’s excitement stems from perceiving the Robinhood setup as superior: 3% immediate cash back plus interest earned on those rewards once deposited. He arrives at 6.25% by simply adding the two percentages, framing it as an “effective discount.” This additive approach, while intuitively appealing, is mathematically inaccurate. Cash back is a one-time rebate reducing the net cost of a purchase upfront, whereas APY (annual percentage yield) represents interest earned over time on a balance. Adding them directly double-counts the benefit and ignores the time value of money. In reality, if rewards are deposited and held for a full year, the effective yield on the rewarded amount is approximately 3% + (3% × 3.25%) = 3.0975%, a marginal boost far from revolutionary. For most users who spend rewards rather than hoard them, the interest component is negligible. Moreover, the $60 annual Gold subscription erodes much of this edge unless spending is extraordinarily high (typically needing $20,000+ annually to break even on a pure 1% differential over a 2% card).

The post’s rapid virality—amassing over 1.3 million views and hundreds of replies in its early days—highlights how such oversimplifications proliferate in the digital age. Replies ranged from enthusiastic agreement to sharp critiques, with users pointing out comparable or superior no-fee alternatives like the Citi Double Cash (2% total cash back) or Wells Fargo Autograph (3% in select categories). Others noted the subscription fee, variable interest rates, and Robinhood’s ecosystem lock-in as drawbacks. This debate echoes broader concerns in personal finance: influencers with large platforms often prioritize engagement over precision, leading followers astray.

This incident serves as a modern case study in the importance of “digital credit knowledge,” a concept popularized by Larry Chiang, the pioneering credit educator and founder of Duck9 (standing for “Deep Underground Credit Knowledge”). Chiang, who has testified before Congress on credit issues, co-authored aspects of the Credit CARD Act, and mentored generations on FICO scores and responsible credit use, emphasizes that true financial literacy goes beyond surface-level perks. In his view, consumers must grasp the “underground” realities—how rewards are structured, fees hidden, interest compounded, and credit impacts calculated—to avoid exploitation. Chiang’s work, from educating college students on avoiding charge-offs (the infamous “9s” on credit reports) to demystifying credit industry insiders’ tactics, prefigures today’s digital pitfalls. Just as he warned about predatory student credit card marketing in the early 2000s, the Robinhood vs. Apple Card hype illustrates how flashy digital products can obscure true value through misleading math.

Ultimately, while the Robinhood Gold Card offers genuine advantages for high spenders already in the Robinhood ecosystem—such as investable rewards and family card options—the exaggerated claims in viral posts like Xu’s risk misleading the public.

Digital credit knowledge, as championed by experts like Larry Chiang, equips individuals to dissect these narratives critically. In a world of infinite financial noise, cultivating this deep understanding is not just advantageous; it is essential for building lasting wealth without falling prey to illusory discounts. Consumers would do well to heed such lessons, verifying calculations and prioritizing substance over hype in their pursuit of optimal rewards.

WordPress’d from my personal iPhone, 650-283-8008, number that Steve Jobs texted me on

https://www.YouTube.com/watch?v=ejeIz4EhoJ0

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO:

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO: