What we are witnessing today with the BOJ arguably stands as one of the most significant macro events in recent times and is a roadmap for the broader global economy.

What we are witnessing today with the BOJ arguably stands as one of the most significant macro events in recent times and is a roadmap for the broader global economy.Ultimately central banks of highly indebted economies have no choice but to become the ultimate buyers of their own government debt.

The Fed is not exempt from this.

The current monetary policy in the US is starkly misaligned with the surge in Treasury issuances and the prevailing levels of fiscal irresponsibility.

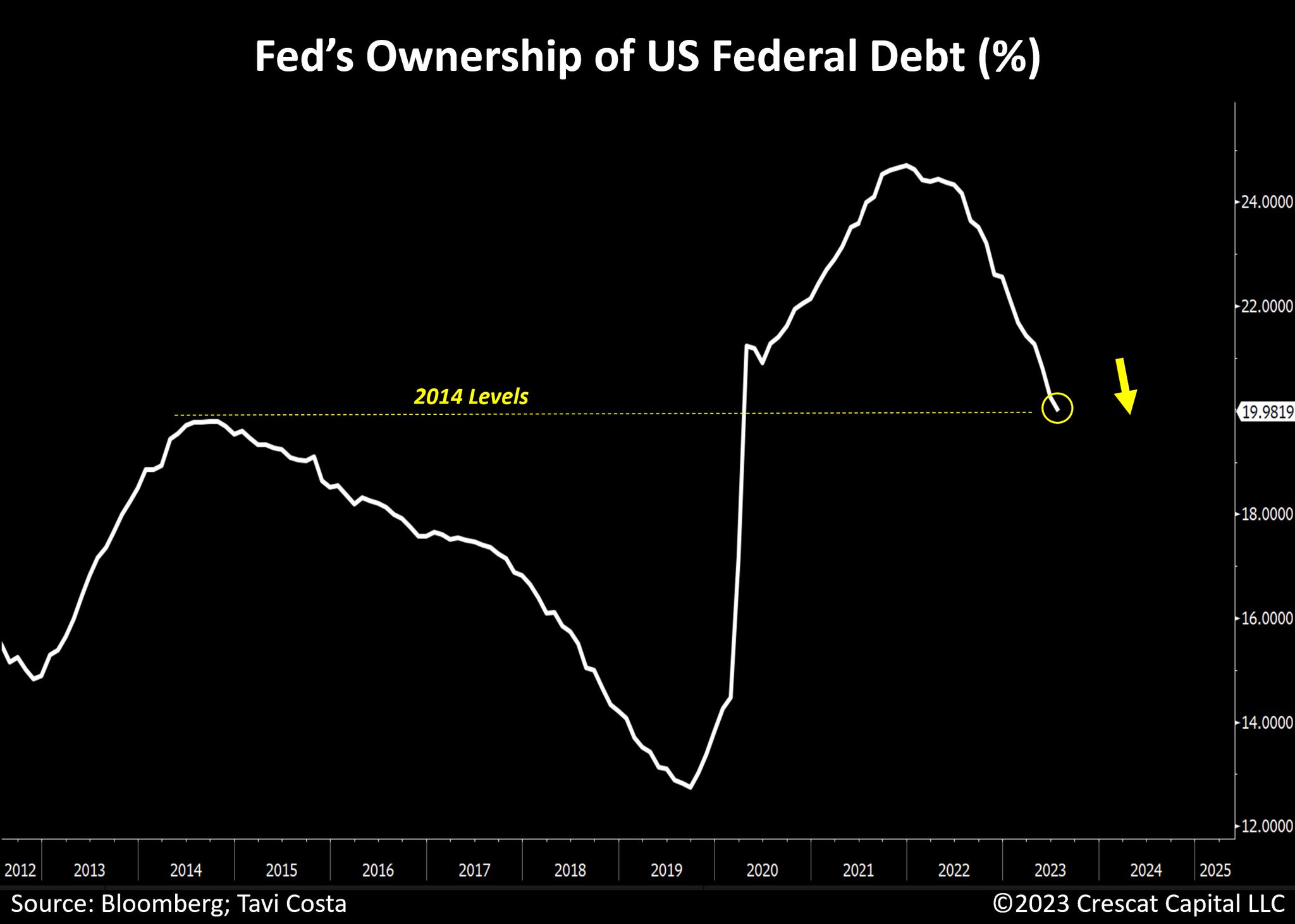

It’s important to note that the Fed’s ownership of US federal debt has recently plunged to 2014 levels.

Inevitably, this trend needs to be reversed.

|

||||||||||||||||||||||||

WordPress’d from my personal iPhone, 650-283-8008, number that Steve Jobs texted me on

https://www.YouTube.com/watch?v=ejeIz4EhoJ0

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO:

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO: