|

||||||||||||||||||||||||

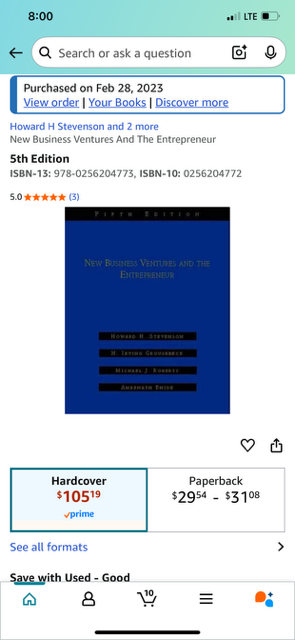

With Irv Grousbeck and Sans Irv Grousbeck Overall Differences Between the 5th and 6th Editions New Business Ventures and the Entrepreneur

Overall Differences Between the 5th and 6th Edition

The book in question is *New Business Ventures and the Entrepreneur*, a casebook used primarily in Harvard Business School’s entrepreneurial management courses. The 5th edition (published 1999 by Irwin/McGraw-Hill) was co-authored by Howard H. Stevenson, Michael J. Roberts, H. Irving Grousbeck, and Amar V. Bhide. It focuses on the entrepreneurial process through a mix of conceptual chapters and Harvard Business School-style cases, emphasizing opportunity evaluation, resource assembly, operations, growth, and exit strategies. The total length is around 678 pages, with a structure divided into parts that include numbered chapters (up to at least 18) and integrated cases.

The 6th edition (published 2006 by McGraw-Hill/Irwin) updates the authorship to Michael J. Roberts, Howard H. Stevenson, William A. Sahlman, Paul W. Marshall, and Richard G. Hamermesh. Key overall changes include:

– **Updated Content and Perspective**: Reflects post-dot-com bubble realities (e.g., more emphasis on sustainable business models, risk management, and valuation in uncertain markets). New sections on intellectual property protection, venture capital evaluation, deal structuring, and legal forms of organization. The tone shifts slightly toward practical tools for early-stage ventures, with greater integration of financial and legal considerations.

– **Restructured Format**: Reduced from ~18 chapters to 11 main chapters, organized into 5 parts. Cases are more tightly integrated with chapters, and the book is shorter (around 697 pages but with denser case integration). This makes it more streamlined for classroom use, focusing on “managing the early-stage venture” and “realizing value” rather than exhaustive chapter-by-chapter breakdowns.

– **New and Updated Cases**: Many classic cases from earlier editions are retained or revised, but new ones are added (e.g., Zipcar on business model refinement, NanoGene Technologies on team assembly, RightNow Technologies on growth). Outdated cases are replaced to include more contemporary examples from the early 2000s, such as Keurig (coffee pods) and Innocent Drinks (beverage startup). Emphasis on diverse sectors like tech, social enterprises, and international expansion.

– **Enhanced Focus Areas**: Greater attention to human resources (e.g., team building), financing (e.g., capitalization tables, due diligence), and growth challenges (e.g., scaling operations). The 6th edition includes more notes on tools like business model canvases and valuation methods, aligning with evolving entrepreneurship pedagogy.

– **No Major Conceptual Overhaul**: Core framework remains the same—evaluating opportunities, assembling resources, managing operations/growth, and harvesting value—but with fresher examples and less emphasis on 1990s-specific contexts like early internet ventures.

These changes make the 6th edition more relevant for the mid-2000s entrepreneurial environment, but it retains the case-method approach central to the series.

### Specific Differences in Chapter 17

The 5th edition has a dedicated Chapter 17 titled “Managing Growth: Bankruptcy,” positioned in the later sections on scaling ventures and handling crises. It explores how entrepreneurs navigate financial distress, reorganization, and failure as part of growth management. Key elements include:

– **Conceptual Content**: Discussion of bankruptcy as a strategic tool (e.g., Chapter 11 reorganization vs. liquidation), risk-reward trade-offs in rapid scaling, warning signs of overextension, and lessons from failed or recovering ventures. It ties into broader themes of entrepreneurial resilience and when to pivot or exit.

– **Cases Included**:

– **Dragonfly Corporation** (a classic case from 1983, revised for the edition): Focuses on a manufacturing firm’s descent into bankruptcy due to poor cash flow management and market shifts. Entrepreneurs must decide on reorganization strategies.

– **Gordon Biersch Brewing Company** (2002 case): Examines a craft beer startup facing growth pains, debt overload, and potential bankruptcy. Highlights operational scaling issues and creditor negotiations.

– **Length and Focus**: Approximately 20-30 pages of text plus cases, emphasizing legal and financial mechanics of bankruptcy in entrepreneurial contexts.

In contrast, the 6th edition **does not have a Chapter 17** (or any chapter numbered 17). The book’s restructured format consolidates growth-related topics into Part V: “Managing Growth and Realizing Value,” primarily under Chapter 11: “Managing the Growing Venture.” This reflects a broader reorganization where discrete chapters on specific subtopics (like bankruptcy) are merged into thematic parts with integrated cases. Relevant content on bankruptcy and growth crises is dispersed as follows:

– **Conceptual Content**: Bankruptcy is not a standalone chapter but is woven into Chapter 11’s discussion of scaling risks, resource constraints, and value realization. It covers similar ideas (e.g., financial distress, reorganization options) but in a more concise, tool-oriented way, often referencing legal notes from Chapter 10 (“The Legal Forms of Organization”). Emphasis is on proactive risk management rather than post-crisis recovery.

– **Cases and Integration**: No direct equivalents to the 5th edition’s bankruptcy-focused cases. Instead, growth and distress themes appear in:

– **Kendle International, Inc.**: A contract research organization facing acquisition and scaling pressures, touching on financial strain but not explicit bankruptcy.

– **RightNow Technologies**: Software firm dealing with rapid growth, funding challenges, and potential overextension (implicit distress risks).

– **Jamie Dimon and Bank One (A)**: Leadership in turnaround situations, including post-crisis recovery (broader than bankruptcy but relevant to entrepreneurial pivots).

– Other cases in Part V (e.g., Shurgard Self-Storage on international expansion risks) indirectly address failure modes without a dedicated bankruptcy lens.

– **Length and Focus**: Chapter 11 is shorter (~15-20 pages) with 6 integrated cases, prioritizing positive growth strategies over failure scenarios. Bankruptcy mechanics are likely cross-referenced to earlier legal/financing chapters rather than explored in depth here.

**Key Differences in Chapter 17 (or Equivalent)**:

– **Existence and Structure**: 5th edition has a explicit, focused chapter; 6th edition integrates the topic into Chapter 11, making it less prominent and more holistic.

– **Depth on Bankruptcy**: Deeper in the 5th (dedicated cases on reorganization and failure); shallower in the 6th, treated as one risk among many in growth management.

– **Cases**: 5th features specific bankruptcy stories (Dragonfly, Gordon Biersch); 6th uses broader growth cases with implicit distress elements, reflecting a shift toward success-oriented narratives.

– **Pedagogical Shift**: 5th emphasizes learning from failure explicitly; 6th focuses on prevention and scaling tools, aligning with the new authors’ expertise in venture capital and operations.

With Irv Grousbeck and Sans Irv Grousbeck Overall Differences Between the 5th and 6th Editions New Business Ventures and the Entrepreneur

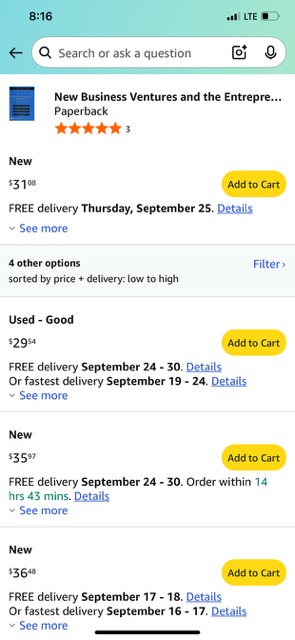

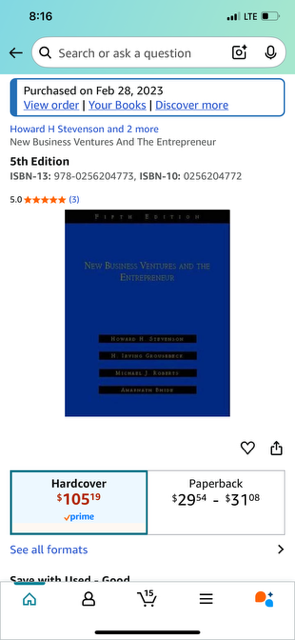

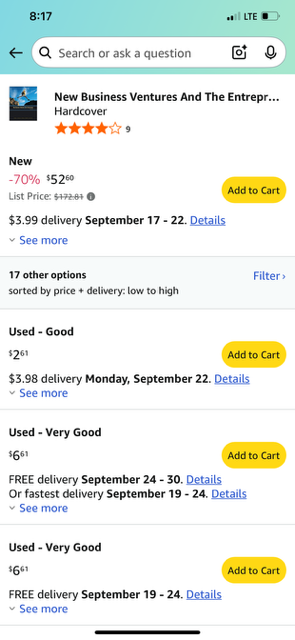

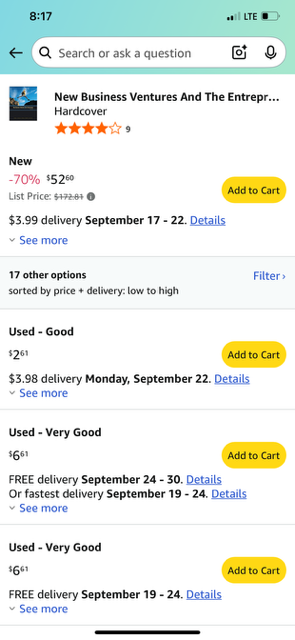

$100++ vs $5

And the price plummeted when Irv Grousbeck was dropped

|

||||||||||||||||||||||||

Chapter Hunter Pence

http://www.youtube.com/watch?v=usu0luYy9pw

New Business Ventures and the Entrepreneur Edition 7 would be code named #swe277p

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO:

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO: