Larry Chiang back doored his way by force on to the New York Times Best Seller list by reverse shoplifting his book into the Whole Foods at Columbus Circle and pre-promoting months-and-months before NY fashion week launch, “09-09-09” of “What They Don’t Teach You At Stanford Business School”. By debuting the book at Sundance and SXSW film festivals, Hollywood optioned WTDTYASBS. He’s testified before Congress and during TV interviews he tracks his own “mentor mentions per press interview” (#MMPPI) His mentors are Gerri Detweiler and Mark McCormack. Yes Gerri Detweiler of “Ultimate Credit Handbook” fame and Mark McCormack of, “What They Don’t Teach You at Harvard Business School” fame. Play and practice entrepreneurship with Larry’s ideas about crashing parties before and during, #CS178.

New York Fashion Week (#NYFW) takes the best brands and helps them launch. — Larry Chiang |

By Larry Chiang

Crashing parties = Making startup headway.

|

Bob Metcalfe (@BobMetcalfe) |

|

Startup Innovation: Unbundling Car, Disrupting Automobile Industry: whatsthebigdata.com/2015/06/07/sta…

|

|

This is what exists too:

|

Larry Chiang (@LarryChiang) |

|

There is an OBII port, @BobMetcalfe. In short, we can crash that industry “without their permission”. #externalAPI

|

|

The signature business maneuver of “external API” is curated at #externalAPI. The purpose of External, ‘Application Protocol Interfacing’ is to

|

Larry Chiang (@LarryChiang) |

|

Fraiche @fraiche sells “Oreo” flavored frozen yogurt. Know what me and Olaf know: It’s a mutha scrathin’ #externalAPI

|

|

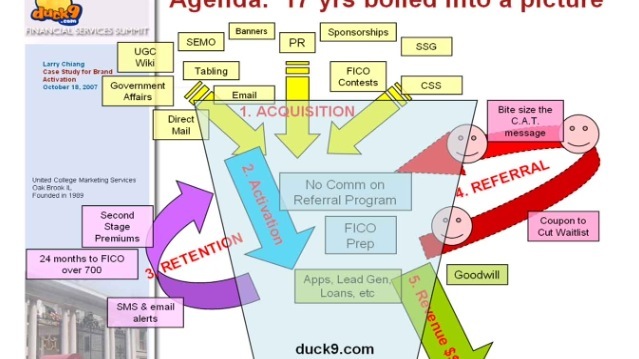

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO:

Duck9 is a credit score prep program that is like a Kaplan or Princeton Review test preparation service. We don't teach beating the SAT, but we do get you to a higher credit FICO score using secret methods that have gotten us on TV, Congress and newspaper articles. Say hi or check out some of our free resources before you pay for a thing. You can also text the CEO: